Australian Dollar Analysis and Talking Points

- AUD/USD | Consolidating Above 200DMA, Risk Sentiment Supports

- Australian Dollar Eyes Critical Jobs Data

- Rising RBA Rate Cut Expectations Likely to Spark Reversal

AUD/USD | Consolidating Above 200DMA, Risk Sentiment Supports

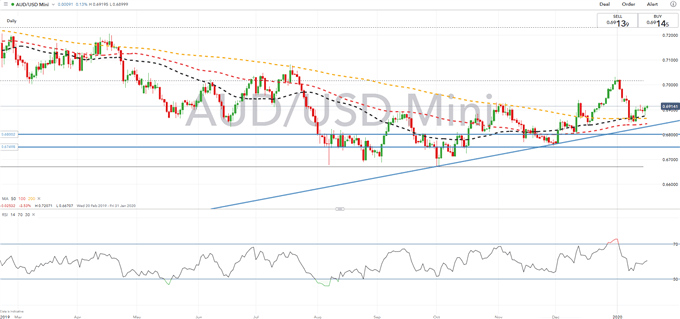

AUD/USD has managed to consolidate above its 200DMA (0.6864) as risk sentiment remains positive with equity markets going from strength to strength. This has been particularly evident in the ASX 200, which has risen over 5% in the past 10 trading sessions, trading above 7000 for the first time in history. However, with a rate cut from the RBA at the February meeting remaining the balance, the Australian jobs report (Jan 23rd) and CPI data (Jan 29th) over the coming weeks, will be crucial to the Australian Dollar. As such, with markets pricing in a 44% chance of a 25bps rate cut, softer economic figures are likely to see the pair break back below 0.6900 and make a retest of the 200DMA.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

On the technical front, momentum indicators signal that AUD/USD is lacking in terms of notable direction with both positive and negative DMIs trending lower. Throughout today’s session, upside the pair may be limited with $1bln worth of vanilla options situated at 0.6930-35.

AUD/USD Vanilla options: 0.6875 (885mln), 0.6905-20 (1.1bln), 0.6930-35 (1bln).

Implied 1-Week range (0.6860 – 0.6960)

| Support | Resistance | ||

|---|---|---|---|

| 0.6876 | 50DMA | 0.6930-35 | Vanilla Options |

| 0.6864 | 200DMA | 0.6940 | December 12th Peak |

| 0.6830 | Trendline Support | 0.6950 | - |

AUD/USD Price Chart: Daily Time Frame (Feb 2019 – Jan 2020)

Source: IG Charts

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX