Japanese Yen Outlook:

- The Japanese Yen has fallen versus the US Dollar since late August despite the Fed’s balance sheet expansion

- Consequently, USD/JPY surpassed trendline resistance from 2018 which may now provide support

- AUD/JPY has also rallied, but failed to post a higher-high like USD/JPY which may leave the door open for bearish opportunities

USD/JPY Forecast

The Japanese Yen has faltered against the US Dollar in recent weeks, even as the Fed has expanded its balance sheet, flushing more Dollars into the economy. Despite the seemingly bearish headwind for the Greenback, a period of subdued volatility and robust risk appetite has helped to lift USD/JPY to its highest level since May 2019. In turn, the pair has broken a descending trendline dating to October 2018, a development that could allow for an extension higher – or an early area of support if risk aversion should emerge.

That being said, the week ahead possesses the potential to spark such an emergence. Among a collection of other Yen crosses, USD/JPY and AUD/JPY have seen their implied volatilities wilt to near record lows – which has likely played a role in the Yen’s weakness – but the upcoming trade deal signing between the United States and China could usher in a fresh regime of volatility.

After negotiating for months, the two sides were seemingly unable to agree on many matters until the surprise announcement was made in mid-December that the two sides had come to a Phase One agreement. Since then, risk assets like the S&P 500 and Dow Jones have surged, while volatility – via the VIX – and the Yen have been pressured. Therefore, if the trade deal is short on details or market expectations are not met, the event could bolster the Yen as risk aversion climbs.

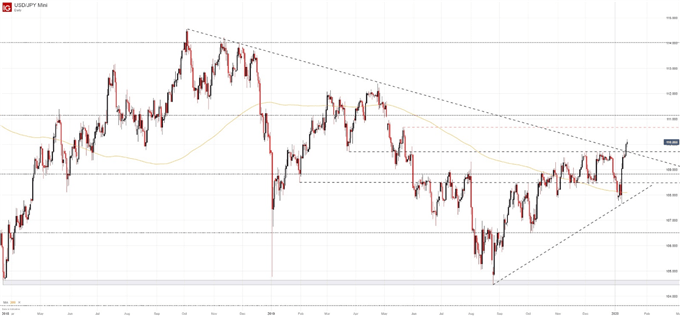

USD/JPY Price Chart: Daily Time Frame (April 2018 – January 2020) (Chart 1)

In the case of USD/JPY, a series of higher highs and higher lows from August paint an encouraging picture for the medium-term. Surging above a descending trendline from October 2018, the pair may look to employ the level as support if needed.

Similarly, USD/JPY may enjoy buoyancy from the horizontal level at 109.71 which influenced price throughout December. Together, the two areas will look to ward off a deeper retracement that could look to target 108.47 or the 200-day simple moving average. In the meantime, follow @PeterHanksFX on Twitter for updates.

AUD/JPY Forecast

AUD/JPY is another Yen cross which has enjoyed a boost since August, but bulls have been somewhat more constrained. Unlike USD/JPY, the Australian Dollar failed to post a new higher-high versus the Yen since late December as horizontal resistance around the 76.40 level has kept a lid on the pair.

Fundamentally speaking, it can be argued AUD is more sensitive to changes in risk appetite than the US Dollar, so AUD/JPY may provide a better opportunity for bearish biases to be exercised than USD/JPY – especially when considering the technical formations.

AUD/JPY Price Chart: Daily Time Frame (December 2018 – January 2020) (Chart 2)

With that in mind, the 200-day simple moving average and the descending trendline from December 2018 will look to act as initial support around the 74 level. If, on the other hand, trade war proceedings impress the market, it would be within reason to expect a continuation higher for AUD/JPY.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: How to Invest During a Recession: Investments & Strategy