USD PRICE OUTLOOK: US DOLLAR COMES UNDER PRESSURE AS NONFARM PAYROLLS MISSES ESTIMATES

- The US Dollar edged lower in response to the latest jobs report for December that detailed a +145K net change in nonfarm payrolls (NFP) and compares to the consensus estimate of +160K

- USD/JPY dropped roughly 20-pips in response to the disappointing NFP report while the reaction in spot USD/CAD was more dramatic with nearly a 45-pip move as Canadian jobs data beat estimates

- Read more on how Nonfarm Payrolls Drives the US Dollar & Currency Volatility

December NFP data just crossed the wires and pushed the US Dollar toward session lows as job growth in America continues to slow.

USD price action came under pressure with the latest jobs report disappointing forex traders as the headline net change in nonfarm payrolls came in at +145K, which compares to the market estimate looking for +160K and prior period’s reading of +266K.

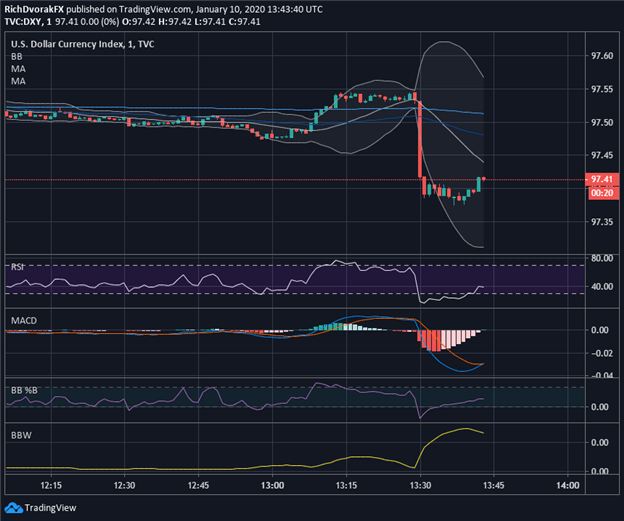

US DOLLAR INDEX PRICE CHART: 1-MINUTE TIME FRAME (JANUARY 10, 2020 INTRADAY)

Chart created by @RichDvorakFX with TradingView

The DXY US Dollar Index fell roughly 0.20% to print a fresh session low in response to the news and currently trades near the 97.40 price level.

USD/JPY PRICE CHART: 1-MINUTE TIME FRAME (JANUARY 10, 2020 INTRADAY)

Spot USD/JPY fell from the 109.68 level toward the 109.50 handle following the disappointing NFP data, but has since recovered roughly 10-pips as the US jobs report suggests that the US labor market remains healthy overall.

This interest rate sensitive forex pair tends to respond closely to changes in interest rate expectations due largely to USD/JPY’s popular use in the currency carry trade.

USD/CAD PRICE CHART: 1-MINUTE TIME FRAME (JANUARY 10, 2020 INTRADAY)

The US Dollar came under pressure particularly against the Loonie which ripped higher against most major currency pairs as the Canadian jobs report topped consensus estimates.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

Spot USD/CAD dropped about 45-pips on the news and is currently searching for support around the 1.3030 price level.

Read More: US Dollar Hinges on Jobs Data & Fed Repos – USD Levels to Watch

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight