Australian Dollar Analysis and Talking Points

- AUD/USD | Contained by Cluster of DMA’s

- Australian Dollar Rises on Retail Sales Report

- Jobs and Inflation Reports are Pivotal to February Rate Decision

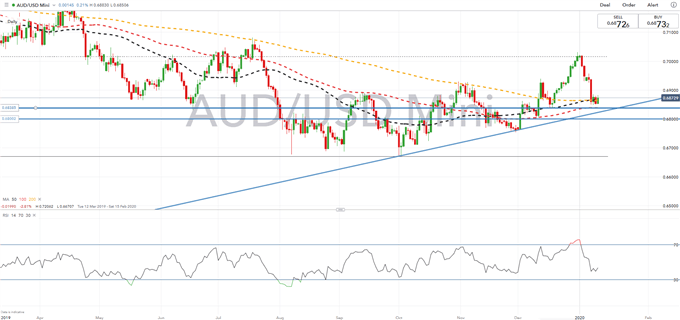

AUD/USD | Contained by Cluster of DMA’s

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

Overnight, the Australian Dollar had been supported by better than expected retail sales data amid the impact of Black Friday sales. Although, while this may have seen a slight easing of RBA rate cut bets, the seasonal effects in the data somewhat masks the underlying strength of consumption, therefore a clearer image will be provided in the December report. That said, with expectations of a rate cut from the RBA in February split 50/50 focus will be firmly fixed on the Australian jobs report (Jan 23rd) and CPI figures (Jan 29th).

On the technical front, AUD/USD has been contained between 0.6850-0.6900 as the pair consolidates after its topside rejection from the beginning of the year. On the downside, support is situated at 0.6838, which marks the December 17/18th double bottom and coincides with the 100DMA, while topside resistance hovers around 0.6890-0.6900.

Implied range for next week (0.6820 – 0.6930)

| Support | Resistance | ||

|---|---|---|---|

| 0.6838 | Dec 17/18 double bottom | 0.6882 | Yesterday’s High |

| 0.6825 | Trendline Support | 0.6890-0.6900 | - |

| 0.6800 | Dec 10th low | 0.6950 | - |

AUD/USD Price Chart: Daily Time Frame (Mar 2019 – Jan 2020)

Source: IG

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX