Philippine Peso, Crude Oil Prices, Inflation, BSP- Talking Points

- Philippine Peso gained on stronger-than-expected local inflation

- Philippine CPI pushed higher by taxes and rising crude oil prices

- BSP increased upside inflation outlook, USD/PHP eyeing support

Philippine Peso Gains as Crude Oil Prices Help Fuel Local Inflation

The Philippine Peso extended its rally against the US Dollar on Tuesday following a stronger-than-expected local inflation report. USD/PHP has been on a near-term decline after fears of US-Iran geopolitical escalation cooled. Now the focus appears to have shifted to how the data could potentially drive the Philippine Central Bank (BSP) ahead.

Inflation surprised at 2.5 percent y/y in December versus 2.0% expected and up from 1.3% in November. That was the highest reading since June 2019 and could be explained by a couple of reasons. First, alcoholic beverage and tobacco CPI clocked in at 18.4% which was the fastest pace since the end of 2018. This followed speculation and introduction of excise taxes on these products by the government last year.

Meanwhile, transportation costs increased 2.2% during the same period which was the strongest since the Summer of 2019. This is also in conjunction with the rally in crude oil prices since October. The commodity is a key import. Shortly after the data crossed the wires, BSP Governor Benjamin Diokno said that the risk to their inflation outlook is tilted to the upside for 2020.

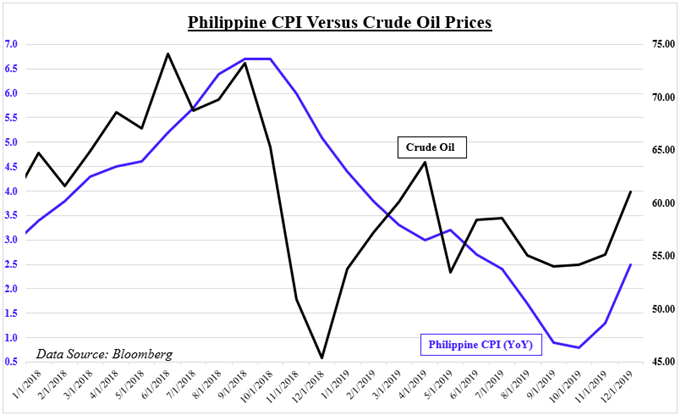

Looking at the chart below, you can see the close relationship between WTI Crude Oil and headline Philippine CPI. The BSP still sees a 25-bp rate cut during the first quarter, but rising local bond yields on the data likely dented further easing bets. Further gains in the commodity would likely continue reducing these expectations, perhaps offering some lift to the PHP. Though US-Iran geopolitical risks may cool gains.

Philippine Peso Technical Analysis

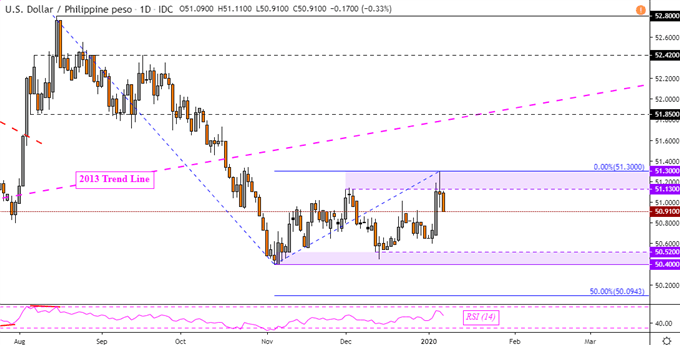

USD/PHP turned lower after failing to push into the key psychological barrier between 51.13 and 51.30. Prices have been in a consolidation mode since bottoming in November. That places the focus on key support which is a range between 50.40 and 50.52. Taking out the latter opens the door to prolonging the former downtrend. To learn more, check out my latest ASEAN technical outlook.

USD/PHP Daily Chart

Crude Oil Technical Analysis

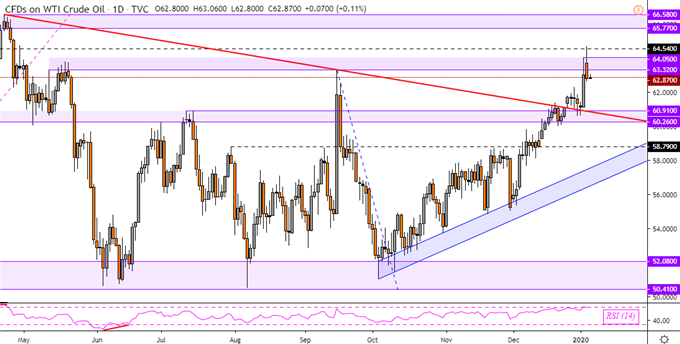

Crude oil prices found restraint after accelerating the advance through falling resistance from April, red line on the chart below. Resistance held as the horizontal range between 63.32 to 64.05. On balance, the push above the trend line leaves the near-term technical bias to the upside. However, recent changes in IG Client Sentiment offer a downside outlook at the time of this writing.

WTI Crude Oil Daily Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter