Canadian Dollar Analysis and News

- Canadian Dollar Buoyed by Rising Oil and Equity Markets

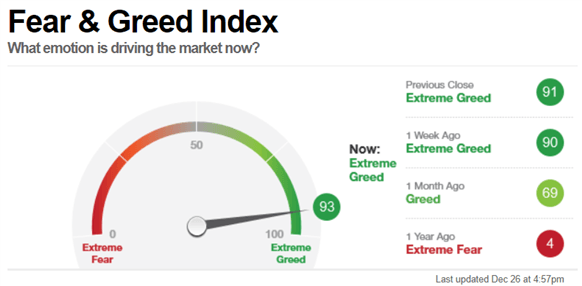

- Extreme Greed Raises Scope for Reversal in Risk Sentiment

Canadian Dollar Buoyed by Rising Oil and Equity Markets

The commodity linked Canadian Dollar has continued to strengthen against the greenback as oil prices edge higher, while equity markets have also extended on its gains. Consequently, USD/CAD is trading at its lowest level since October 30th with the pair dipping towards the 2019 low (1.3016). With European equities pushing higher throughout the morning session, this has spilled over into US equity futures with the S&P 500 gaining 0.3%, alongside this, the tech heavy Nasdaq 100 is so far reporting its best month since June, having risen over 4.6% thus far.

Extreme Greed Raises Scope for Reversal in Risk Sentiment

That said, given the continued appreciation in equity markets, positioning on the upside may become somewhat stretched amid the CNN Fear & Greed Index highlighting that current market conditions are in extreme greed territory. As such, with risk reward for further gains appearing less attractive, equity markets are at risk of a potential reversal and thus pro-risk currencies such as the CAD, AUD & NZD may experience a speed bump. In turn, we would expect the 2019 low to hold for now.

USDCAD: Daily Time Frame (May 2019 – Dec 2019)

Chart by IG

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX