Sterling (GBP) Price Analysis and Outlook

- Positive start for Sterling.

- Data releases and/or BoE may shift sentiment.

Sterling Looks Set to Fade Higher

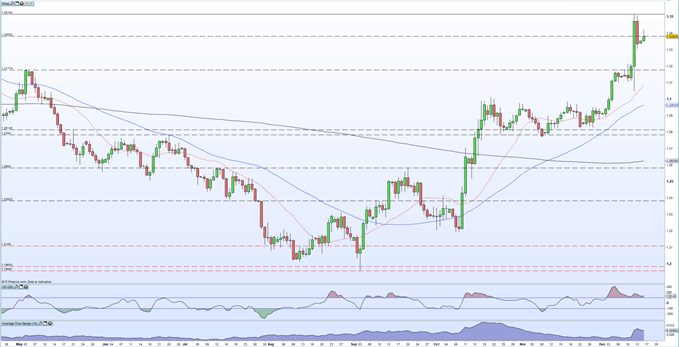

The British Pound opens the week in positive territory and looks set to push higher as we head towards the end of the year. Last week’s resounding victory for the Conservative party fuelled the initial move and with little in the way of short-term negative news, the push higher should continue. While the chart set-up remains positive, the gradual winding down of the market ahead of Christmas will temper any move, and the 1.3515 high made last week in GBPUSD may be out of reach this week. Volatility has picked up and GBPUSD currently looks overbought, using the CCI indicator. Any sell-off should find support and buyers just above 1.3200.

Sterling (GBP) Weekly Forecast – Short-Term Opportunities Opening Up

GBP/USD Daily Price Chart (April - December 16, 2019)

EUR/GBP – Further Downside Beckons

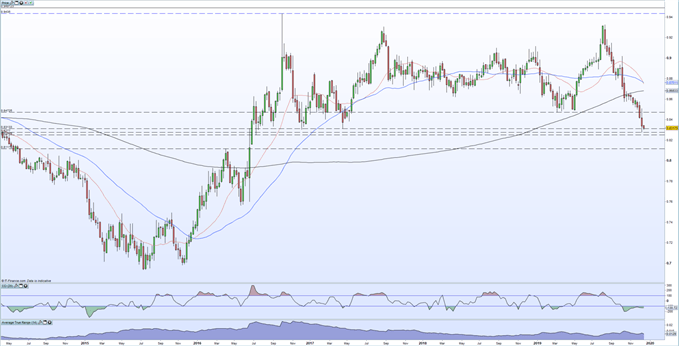

EUR/GBP hit its lowest level in nearly three-and-a-half years last week as sellers dominated the market. A look at the weekly chart shows little in the way of support after 0.82509 until the market gets down to 0.81175. Longer-term, if the Brexit trade talks go well, EURGBP may re-trace back to the 0.7560 level. The weekly chart shows a potential death cross forming – 50-dma going below the 200-dma – and this suggest lower for longer. The chart is slightly oversold which may slow down any move lower.

EUR/GBP Weekly Price Chart (May 2014 – December 16, 2019)

Ahead this week, the provisional Markit manufacturing and services data, the monthly UK wages and employment numbers, along with the latest inflation release and the Bank of England monetary policy announcement. For a full rundown of all market moving economic data and events see the DailyFX Calendar

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling (GBP) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.