EUR/USD Price Forecast, Analysis and Chart:

- EUR/USD volatility remains near multi-year lows.

- FOMC and ECB press conferences to offer further guidance.

Brand New Q4 2019 USD and EUR Forecast and Top Trading Opportunities

Central Bank Talk Will Shape EUR/USD Price Action

EUR/USD volatility remains near multi-year lows as traders wait for the latest FOMC and ECB policy meetings with both central banks expected to leave policy measures unchanged going into the year-end. Both central banks will also give updated inflation and growth expectations against a background of ongoing US-China trade talks, a dispute that has weighed heavily on global growth over the last 18 months. Both economies have shown signs of picking-up recently with the last US Labour report reporting strong job growth, while recent EZ data has picked from lowly levels.

Live FOMC Rate Decision Coverage Webinar – December 11 – 18:45 GMT Onwards

Live ECB Rate Decision Coverage Webinar – December 12 – 12:30 GMT Onwards

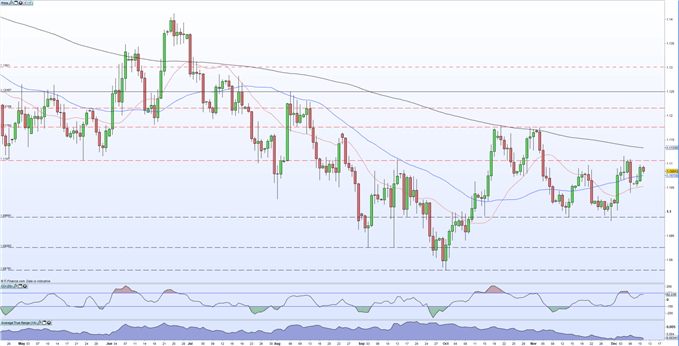

EUR/USD price action has been very limited of late with volatility, using the Average True Range indicator – showing the pair trading near multi-year vol lows. This has inpart helped to keep EUR/USD in a tight trading range over the last few weeks with little in the way of fundamental drivers to steer the pair. The technical outlook looks lightly more positive for EUR/USD today with an open above the 20- and 5-day moving averages helping to underpin support. Short-term support around the 1.1040-1.1050 area needs too hold to prevent the pair attempting recent lows at 1.10030 (December 2) and 1.0981 (November 29). Any weakening of the US dollar today could see the December 4 high at 1.1113 come under pressure.

Ahead of the FOMC today, the latest US inflation data is released at 13:30GMT. For all the major economic data releases and the updated events schedule, see the DailyFX Economic Calendar.

The IG Client Sentiment shows that traders are 54% net-short EUR/USD, giving us a bullish contrarian outlook.

EUR/USD Daily Price Chart (April – December 11, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the Euro and the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.