Silver Prices, Trump Hong Kong Bill– TALKING POINTS

- Silver prices rise after Trump signs Hong Kong bill

- It could catalyze an upside breakout in XAG/USD

- Why are precious metals gaining amid trade war?

Learn how to use politicalrisk analysis in your trading strategy !

Silver prices edged higher early into Asia’s Thursday trading session after news broke that US President Donald Trump signed the Hong Kong Human Rights and Democracy Act. The approval of the legislation is a slap to China’s face after Beijing – as a concession to the US – agreed to raise the penalties for firms violating intellectual property rights, a key concern for Washington.

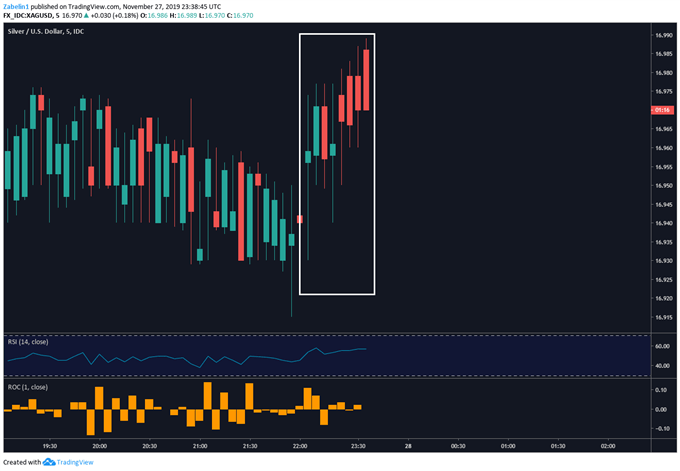

Silver Prices – 15-Minute Chart

XAG/USD chart created using TradingView

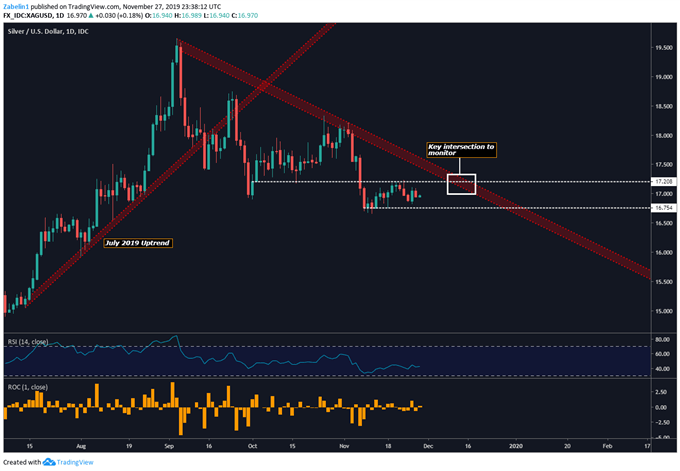

Looking at a daily chart shows the silver-US Dollar exchange rate has been stuck in a congestive range since November 8. However, the recent news could catalyze a breakout above 17.208, though upside momentum may be curbed by September descending resistance. A breach above both ceilings could mark a tectonic shift in the pair’s trajectory if it inspires a bullish outlook. Year-to-date, silver prices are up almost 10 percent.

XAG/USD – Daily Chart

XAG/USD chart created using TradingView

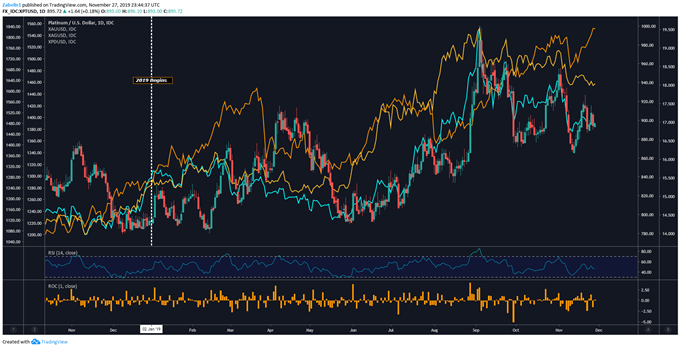

Precious metals have risen throughout 2019 alongside expectations of easing from the Federal Reserve. Consequently, the demand for anti-fiat hedges – like gold, platinum, silver and palladium – has swelled. The most recent development in the US-China trade war has likely spurred further rate cut bets from the Fed in anticipation that an escalation of tensions will magnify the urgency to ease credit conditions.

XPD/USD, XAG/USD, XAU/USD, XPT/USD

XPT/USD chart created using TradingView

Looking ahead, traders will be closely watching how China will respond after it threatened “unspecified countermeasures” in October when the House first passed the bill. A possible weapon China can utilize is the recent tariff award it was given by the WTO which enables Beijing to legally impose approximately $3.4 billion worth of levies against the US. An escalation from there will likely boost Fed rate cut bets and demand for precious metals.

SILVER TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter