Euro Price Chart, EUR/USD, FOMC, Eurozone GDP – Talking Points

Learn how to use political-risk analysis in your trading strategy !

EUR/USD may erase some of its recent upside movement if Eurozone CPI, GDP and unemployment data reinforce concerns about the region’s growth trajectory. Amid geopolitical oscillations and softer growth out of powerhouse economies – like Germany – data has been tending to underperform relative to expectations. It will therefore not be entirely surprising if these same fundamental factors lead to softer GDP and CPI prints.

Seasonally adjusted year-on-year GDP data is expected to show an advanced print of 1.1 percent, marginally weaker than the prior 1.2 percent outcome. Over the same time measure, core CPI – which excludes good with high price volatility – is expected to remain unchanged at one percent. Looking at the 5Y5Y Euro inflation swap forward, markets clearly have low expectations upside price growth in the Eurozone.

However, EUR/USD’s possible decline may be tempered by the release of US PMI and Core PCE data – the latter being a favorite of the Fed’s to use for calculating the policy outlook. If these indicators miss their estimates, it could magnify the US Dollar’s decline in an environment where it has been weakening amid a renewal in risk appetite and turn away from haven-linked assets.

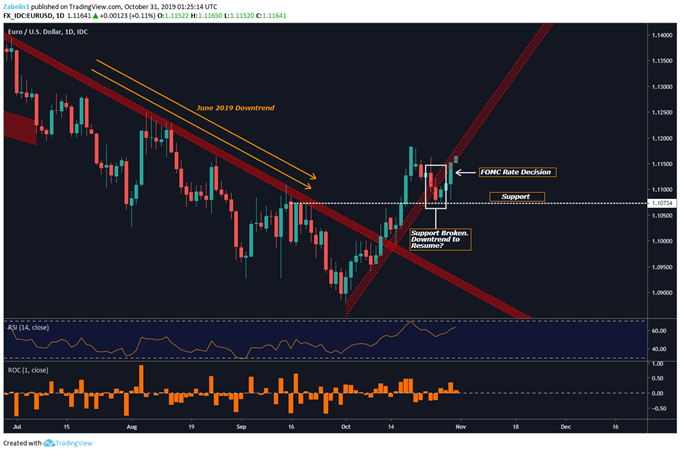

EUR/USD Price Outlook

EUR/USD recently broke through a multi-week uptrend, but the pair’s decline – at least, for now – has been saved by the recent FOMC rate decision. However, upcoming economic data could erase some of EUR/USD’s gains. While the longer-term outlook supports a downside bias, a temporary respite in haven demand may erode upside pressure in the Greenback and strengthen the EUR/USD exchange rate.

Market Analysis of the Day: EUR/USD Likely to Resume Dominant Downtrend – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter