EUR/USD Price Analysis and Talking Points:

EUR/USD Fails to Spike Higher

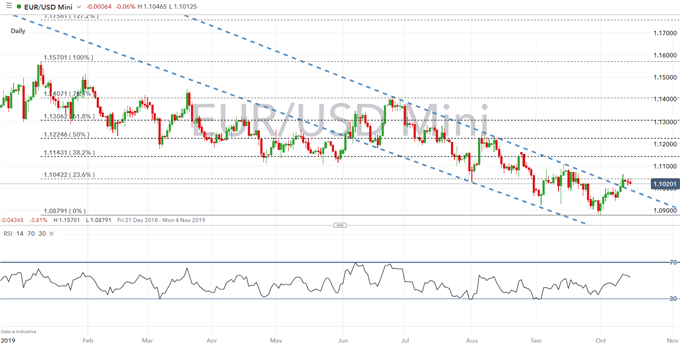

Unlike the Pound, the recent gains in the Euro against the US Dollar have more or less been a grind higher as key resistance curbs any sharp appreciation in the pair. Increased optimism that the UK and EU could potentially reach an agreement before October 31st has seen EUR/USD break out of its 4-month downtrend. However, failure to make a break above the September peak at 1.1109 suggests that this recovery in the Euro is a minor correction as opposed to a meaningful reversal. Therefore, an absence of a deal between the UK and EU before the end of the month could see the Euro maintain its broader downtrend.

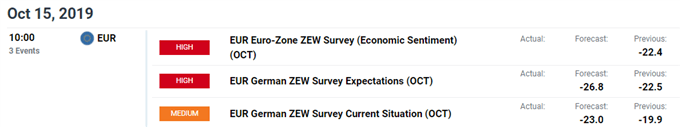

ZEW Survey Set for Another Drop

On the economic calendar, the latest ZEW Survey will be released in which consensus is for another drop. Throughout September, investor angst had been lifted on the repo rate spike, while weak global PMI data had also heightened recession fears. Consequently, a weaker than expected ZEW Survey is likely to keep the Euro modestly under pressure.

EUR/USD Price Chart: Daily Time Frame (Jan 19 – Oct 19)

Resistance 1: 1.1040-45 (23.6% Fib & 50DMA)

Resistance 2: 1.1062 (Last week’s high)

Resistance 3: 1.1109 (September peak)

Support 1: 1.1000 (Psychological)

Support 2: 1.0950

Support 3: 1.0925 (Sep 3rd & 12th bottom)

FX TRADING RESOURCES:

- See our quarterly FX forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX