CAD Price Analysis & News

- USD/CAD Spikes Lower on Strong Canadian Jobs Data

- Employment gains led by full time jobs.

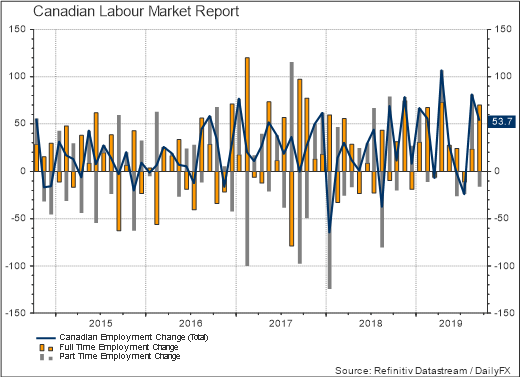

Canadian Jobs Report Recap

The Canadian employment report showed an increase of 53.7k, significantly better than the 10k expected. Alongside this, much of the employment gains had been attributed to the 70k increase in full-time workers suggesting that the quality of jobs has also improved. Elsewhere, the unemployment rate surprised to the downside, falling 0.2ppts to 5.5%, however, this had been a product of the slight fall in the participation rate. While in regard to the wage component, this rose to 4.3% from 3.8%, subsequently completing a set of strong labour market statistics for September.

Employment Change 53.7k vs. Exp. 10k (Prev. 81.1k)

Unemployment Rate 5.5% vs. Exp. 5.7% (Prev. 5.7%)

Market Response

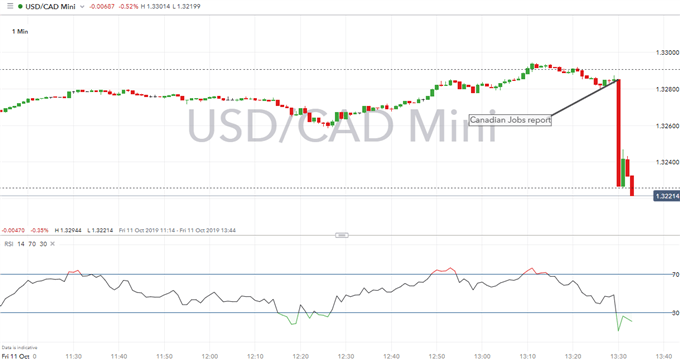

In reaction to the strong labour market report, the Canadian Dollar rose sharply against the US Dollar, resulting in USD/CAD falling to session lows of 1.3211, given that this data will likely keep the BoC on the sidelines for the time being as money markets are pricing in a near certainty that interest rates will be unchanged at the October meeting. Going forward, focus will rest on the outcome of the US-China trade talks with President Trump scheduled to meet the Chinese Vice Premier from 19:45BST.

USDCAD Price Chart: 1-minute time Frame (Intraday)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX