RCEP, Asia FX Markets –TALKING POINTS

- APAC markets closely watching ongoing RCEP trade talks

- Agreement on regional trade framework could boost growth

- Will Japan, South Korea trade war undermine negotiations?

Learn how to use political-risk analysis in your trading strategy !

Regional Comprehensive Economic Partnership: What is it and Why is it Important?

After seven years of work, the China-led Regional Comprehensive Economic Partnership (RCEP) may be on the verge of being finalized and signed either this year or in early 2020. The 16-member agreement – composed of the ten-ASEAN countries, New Zealand, Australia, Japan, South Korea, Singapore and China – is intended to “strengthen economic linkages and to enhance trade and investment related activities”.

“Market access negotiations have advanced substantially, bringing us closer to finalization next year. We are now at the final stage of negotiations” (Singapore Prime Minister Lee Hsien Loong)

The regional trade agreement will not involve the US. But, given Washington’s recent turn to protectionism and deviation from pro-globalization policies, the exclusively Asia-based trade bloc could help reduce the potency of external shocks. As the largest economy in the region, China will play a pivotal role in the bloc’s growth prospects and will act as a sun in the economic solar system around which other members revolve.

Be sure to follow Daniel Dubrovsky on Twitter for technical updates on ASEAN FX markets !

Thailand Minister of Finance Apisak Tantivorawong reinforced this notion when he urged that “the RCEP is very important for this area, especially at a time [when] protectionism is increasing in this world”. Combined, the RCEP not only encompasses almost 50 percent of the world population but also accounts for approximately one third of world GDP.

The subsequent rise in economic activity would boost living standards and create a massive consumer base that could be the driving engine of regional growth. China’s economy has been undergoing a significant economic change as it shifts from a primarily export-driven system to one more based on consumption like the US and EU. The regional trade agreement could lead to other ASEAN countries following a similar path.

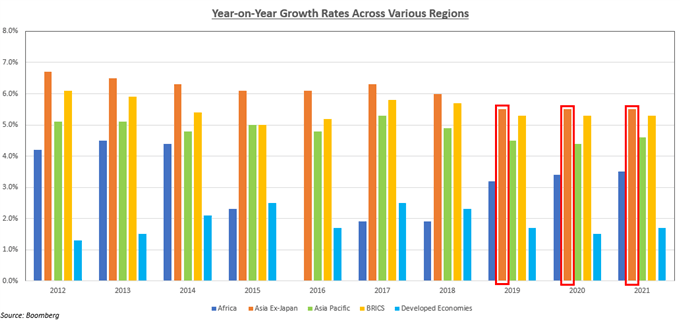

Asia Ex-Japan Estimated to Grow at Fastest Rate Relative to Other Regions

Note: Use of Asia Ex-Japan data is to account for potential slower growth in Japan as a result of the ongoing demographic shift that could distort the growth trajectory of developing economies in the region were it to be included in the same data set.

Obstacles in Trade Negotiations

India has expressed concern about import surges from China will flood the Indian market and undercut local producers. Signing a deal may also be more difficult by virtue of the ongoing trade war between Japan and South Korea. Tensions spilled over into a RCEP meeting as diplomatic relations between the two continues to sour against the global backdrop of shifting political alliances and deviations from liberal-oriented policies.

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter