Asia Pacific Stocks Talking Points:

- Stocks were mixed as a busy week got started

- Energy names did well as oil prices soared

- Haven currencies and those with strong links to energy did especially well

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

Asia Pacific stock markets got off to a mixed start to the week as oil prices rose sharply following drone attacks over the weekend which crippled major production infrastructure in Saudi Arabia. Both international benchmark Brent and West Texas Intermediate were up more than 10% on the day.

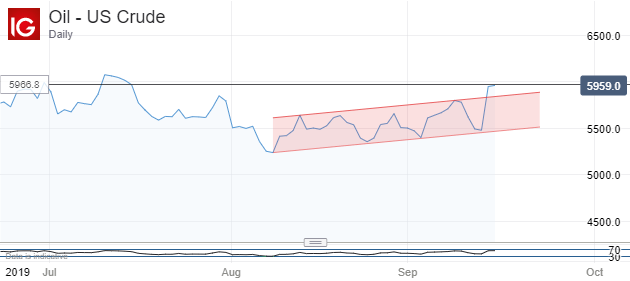

US crude is now back up to peaks not seen since July as markets await news of how long Saudi supply will be reduced.

The market seems pretty well supplied, however, and reports suggest that the main regional impact will be through the possibility of higher prices ahead rather than any immediate supply bottlenecks.

With bellwether market Tokyo closed for a holiday, the Shanghai Composite was up just 0.1% as its afternoon session got under way. The day’s Chinese economic data underwhelmed with retail sales missing forecasts and industrial production rising at its slowest pace for more than seventeen years. Still, a cut in the reserve ratio requirement for banks by the People’s Bank of China took effect Monday. The Chinese central bank said earlier this month that it would cut the requirement in a move which could release 800 billion Yuan (US$113 billion) of liquidity into the economy.

Hong Kong’s Hang Seng slipped 1% with Hong Kong Exchanges and Clearing down more than 2% following the rejection of its bid by the London Stock Exchange. The Kospi managed gains despite a rough session for semiconductor major SKHynix.

The ASX 200 was barely moved overall despite some big changes for individual names. Energy names like Beach Energy and Santos made gains while infant formula name Bellamy’s Australia gained more than 50% on a takeover approach from China’s Mengniu Dairy Company.

In the foreign exchange market, the haven Japanese Yen and Swiss Franc both gained on the US Dollar while petro-linked Norwegian Krone and Canadian Dollar both caught bids.

Events in Saudi Araba have torn market attention away from the Federal Reserve which will give its September monetary policy call on Wednesday. A quarter point cut to the Federal Funds Target Rate is broadly expected, with the extent to which the Fed may concur with market pricing of a second this year very much the market focus.

Asia Pacific Stocks Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!