Norway Sovereign Wealth Fund, Norwegian Krone, Crude Oil Price – TALKING POINTS

- World’s largest petroleum-linked sovereign wealth fund may amplify risk aversion

- Crude oil prices and the sentiment-linked Norwegian Krone may fall on the report

- Local unemployment figures may sour sentiment if the jobs data misses forecasts

See our free guide to learn how to use economic news in your trading strategy !

Crude oil prices and the Norwegian Krone may get dented if Norway’s sovereign wealth fund – the largest in the world worth $1.1 trillion – magnifies concerns about global growth and the prospect of a recession. The petroleum-linked economy and Krone are exposed to oscillations in global sentiment that are frequently reflected in crude oil prices. The Q2 report may reveal how the fund is preparing for what is ahead.

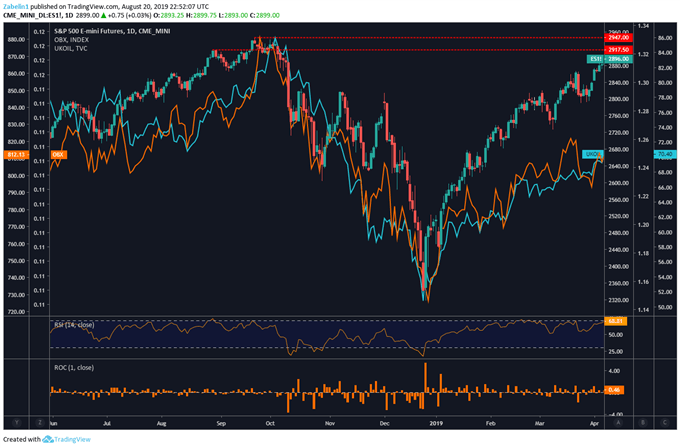

OBX, S&P 500 Futures, Crude Oil Plummeted at the End of 2018

S&P 500 chart created using TradingView

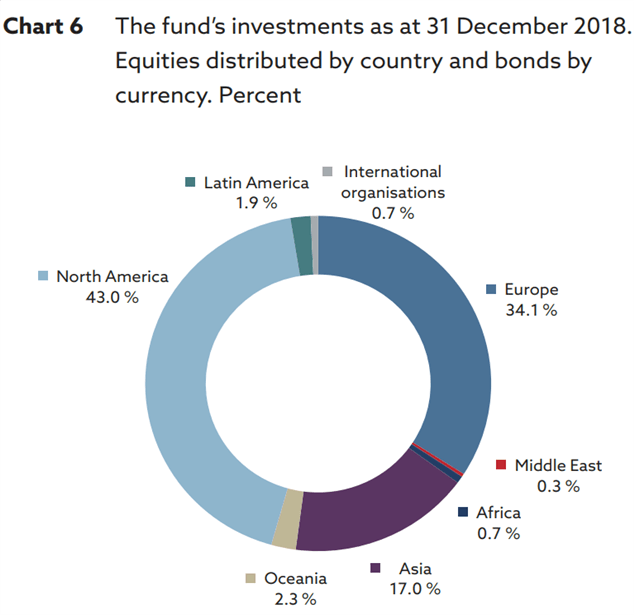

According to the 2018 annual report, the fund reported a loss of 6.1 percent or 485 billion kroner. Equity investments composed 66 percent of the fund’s total asset allocation, far larger than unlisted real estate – 3.0 percent – and over half the size of fixed income – 30.7 percent. The selloff in equities at the end of 2018 naturally dealt a massive blow to the fund and left it with over 232 billion kroner less than the previous year.

Exposed in the Wrong Areas?

Source: Norway Sovereign Wealth Fund 2018 Annual Report

In the face of fierce fundamental headwinds including cross-continental trade wars, emerging market tensions, geopolitical instability in Europe and slower global growth, the fund may re-allocate its capital to assets that perform well under times of financial stress. Certainly, the Norges Bank has felt the pressure of these risks as it trimmed its hawkish outlook at the most recent policy meeting.

Looking ahead, volatility from this may be curtailed by investors who are waiting for the publication of the FOMC meeting minutes and the Jackson Hole symposium. As outlined in my US Dollar forecast, crude oil prices and NOK may fall against USD if the minutes underline the Fed’s neutral stance despite mounting rate cut bets. Comments from officials at the conference may also blow a chilling wind to sentiment.

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter