MARKET DEVELOPMENT – Argentinian Peso Collapses, Japanese Yen Soars, Hong Kong Protests Weaken Equities

DailyFX 2019 FX Trading Forecasts

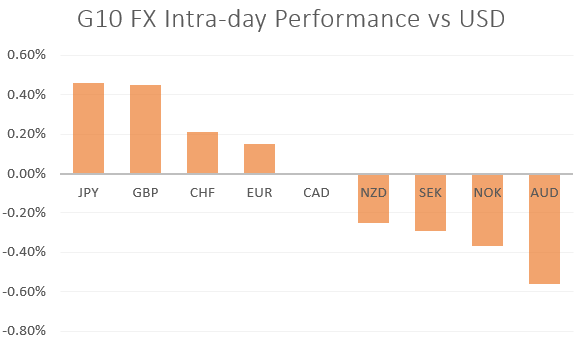

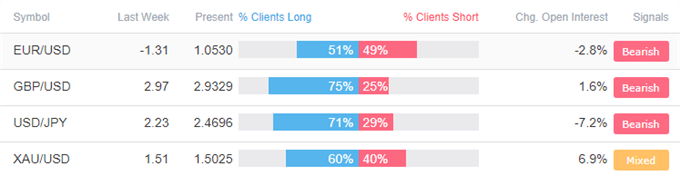

US equity futures are softer with the latest catalyst stemming from the rising political unrest in Hong Kong, in which Hong Kong’s airport had to ground all flights. Notably the Japanese Yen, Swiss Franc and Gold have been the beneficiaries.

ARS: To put it lightly, the Argentinian Peso has capitulated this morning, with the currency dropping nearly 25% against the US Dollar to breach through the 60.00 mark. Consequently, this has dragged other Latam currencies lower with the Brazilian Real slipping past 4.00 against the greenback while the Mexican Peso has dropped 1.4%. Primary elections in Argentina showed voters rejecting President Macri’s policies with the opposition candidate Alberto Fernandez winning by a 15ppt margin, consequently raising concerns that populist policies may soon make a return after the October election.

GBP: Modest gains for the Pound, which ends a third consecutive daily losing streak as EURGBP selling buoys GBP. With little in the way of positive Brexit related headlines and sentiment increasingly bearish, gains will likely remain somewhat limited. Topside resistance at 1.21 holding for now.

JPY: Rising geopolitical tensions across the globe and continued uncertainty surrounding trade wars keeps the Japanese Yen on a path for further appreciation. Safe-haven flows have seen USDJPY make a test of the 105.00 handle, having a hit a low of 105.06, however, $1.6bln worth of vanilla options has helped the 105 level hold for now.

Source: DailyFX, Thomson Reuters

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Dow Jones, S&P 500, and Nasdaq 100 Technical Analysis” by Paul Robinson, Currency Strategist

- “GBPUSD, EURGBP Prices, Brexit and Market Risk - Webinar” by Nick Cawley, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX