AUD/USD, Australia CPI Talking Points

- AUD/USD climbs as rosy Australian CPI cools RBA rate cut expectations

- Follow-through hinges on US-China trade talks and the Fed’s dovish tilt

- Australian Dollar worst daily losing streak since 2015 paused on support

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

The Australian Dollar climbed against its major counterparts after local inflation data crossed the wires and surprised better, overshadowing mixed Chinese PMI data half an hour earlier. In the second quarter, Australian CPI clocked in at 1.6% y/y versus 1.5% anticipated and up from 1.3% in the first quarter.

There was also a surprise beat in the Reserve Bank of Australia’s core measure of price change, the trimmed mean gauge. That measure of CPI printed 1.6% y/y versus 1.5% anticipated and unchanged from the prior quarter. Australian front-end government bond yields rallied, signaling fading expectations of another RBA rate cut in the near-term.

Ahead, the pro-risk Australian Dollar eyes resumption of US-China trade talks in Shanghai and the Federal Reserve monetary policy announcement. Markets were rattled over the past 24 hours when President Donald Trump casted doubt over the truce reached with his Chinese counterpart, Xi Jinping, at the G20 Summit. This may undermine cautious progress made in negotiations.

However, the fundamental outlook for AUD/USD also hinges on how dovish the Federal Reserve appears later today. Markets are anticipating about 2 to 3 cuts by year-end and the central bank’s path may impact the trajectory for where the RBA takes local lending conditions in the medium term. There is also the downside risk for the Aussie is the central bank surprises less dovish.

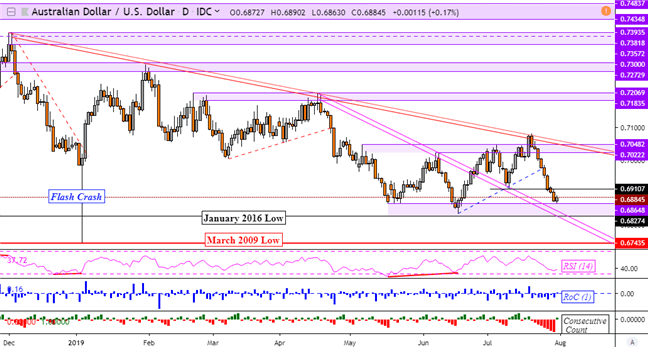

AUD/USD Technical Analysis

The CPI report leaves AUD/USD on the verge of pausing its 8-day consecutive losing streak, the longest going back to 2015. This is also right on the outer boundary of a critical support range between 0.6865 and 0.6827. A push higher places near-term resistance at 0.6911. You can follow me on Twitter for the latest updates in AUD here at @ddubrovskyFX.

AUD/USD Daily Chart

Australian Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Aussie is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter