MARKET DEVELOPMENT – ECB Promises, Turkey Delivers

DailyFX 2019 FX Trading Forecasts

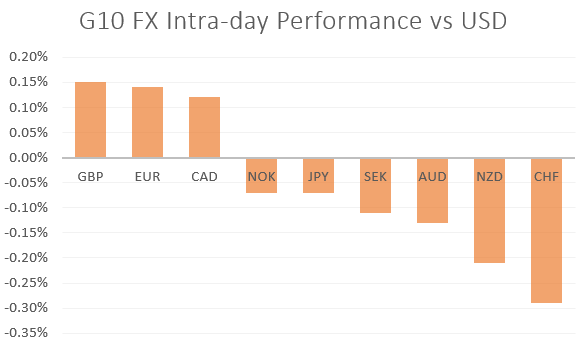

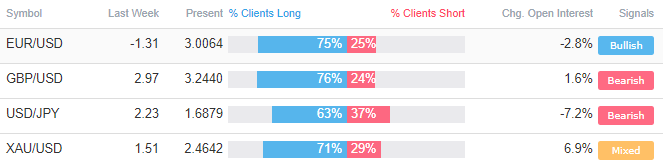

EUR: Wait till September is the message from the ECB. The Euro dropped in reaction to the monetary policy decision, in which the central bank highlight that rates cuts (potential tiering) and restarting of QE is on the way. However, option barriers at 1.1100 held firm with EURUSD hitting intra-day highs of 1.1175 as Draghi avoided providing more dovish commentary. As such, focus now turn towards next week’s Fed meeting, where the central bank is expected to cut interest rates by 25bps.

TRY: The other central bank that had been in focus today was the (Independent) Turkish Central Bank who cut interest rates by a sizeable 425bps to 19.75%. This had been more than the majority of analysts had expected, which was for a cut to 21.5%. Despite this however, Turkey boasts one of the highest interest rates globally, thus bond inflows remain firm. Going forward, the focus will be on the upcoming inflation data.

Source: DailyFX, Thomson Reuters

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “EURUSD Drops as ECB Paves Way for Rate Cut and QE Restart” by Daniela Sabin Hathorn , Junior Analyst

- “UK PM Boris Johnson Doubles Down on Brexit - Sterling (GBP) Nears Breakout” by Nick Cawley, Market Analyst

- “DAX 30 & CAC 40 Technical Outlook Cautiously Constructive” byPaul Robinson, Currency Strategist

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX