Talking Points:

- Oil prices jump higher as tensions in the Gulf continue to escalate

- Natural Gas prices will mirror oil prices due to their reliance on the Strait of Hormuz

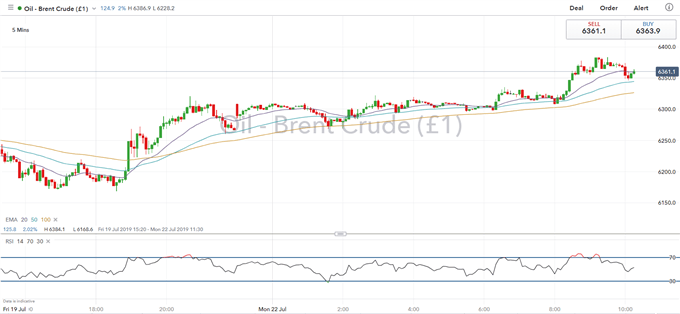

Oil prices jumped higher on Friday after it was reported that Iran had seized a British vessel in the Strait of Hormuz, as tensions continued to escalate in the Gulf. Brent Crude jumped 2.5% on Friday afternoon to $63.21/bbl. heading higher into the weekend before opening higher still on Monday morning at $63.47/bbl.

PRICE CHART: BRENT CRUDE 5-MINUTE TIME FRAME (July 19 – July 22)

Global economies may be pushed into recession if oil prices surge, which would in turn intensify the shift away from fossil fuels. Countries which are heavily reliant on the region’s crude will see an increase in their current account balances as their imports of oil will become more expensive, India will be heavily impacted as a large percentage of its oil imports come from the Gulf. If tensions escalate into armed conflict, we could see oil prices surge back to 2014 levels where a barrel was priced close to $100.

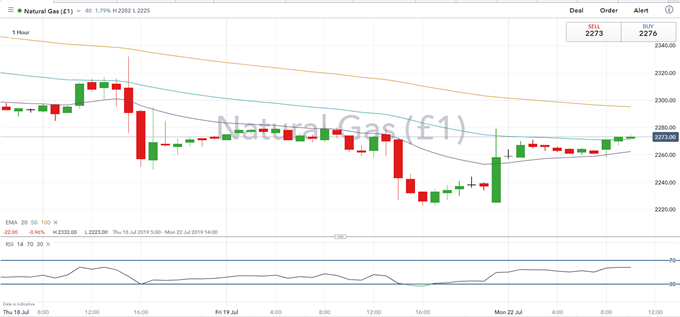

Any increase in the prices of oil is likely to be replicate by natural gas as a greater proportion of shipments of the liquified product pass via the Strait of Hormuz. Natural gas spot prices opened 2.5% higher on Monday in reaction to the recent developments.

PRICE CHART: NATURAL GAS HOURLY-TIME FRAME (July 18 – July 22)

How Tensions Unfolded

Tensions started on July 4 when an Iranian oil tanker was detained by British forces on the coast of Gibraltar after it was believed that the vessel and its 2.1 million barrels of oil were heading to Syria, in breach of EU sanctions. The Iranian tanker continues to be detained as UK officials, backed by the US, determines whether the shipment of oil was heading for Syria. Iran’s Foreign Minister, Javad Zarif, refuses to say where the tanker was heading, as he fears the US will try and place a ban on all Iranian exports, although he denies it was heading for Syria or any other country under the EU ban.

British officials argued that the seizure of the Iranian vessel is only because of its intended destination and not because it is carrying Iranian oil. The UK says it was upholding the EU’s ban on Bashar al Assad’s regime, and UK officials knew there would be retaliation if the tanker and its cargo was not released.

And on Friday July 19 it was reported that a British oil tanker was detained in the Gulf because of failing to observe international maritime regulations. Iranian officials said the vessel met a small fishing boat after which they tried to contact the crew onboard a few times without success. The Revolutionary Guard then approached the vessel and found that it was in violation of various maritime regulations, one of them being that their tracking and GPS devices had been turned off. Another vessel, bearing the Liberian flag, was also detained but later released. To escalate tensions further, it was reported that the US had shot down an Iranian drone after it was performing surveillance duties over the Golf, but the Iran denied the drone was taken down and it confirmed it had returned safely to base. It comes after the US and Iran accused each other of not behaving in good faith.

Theresa May is due to chair an emergency meeting on Monday morning to try and resolve the conflict as swiftly as possible.

Recommended Reading

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q3 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst

To contact Daniela, email her at Daniela.Sabin@ig.com

Follow Daniela on Twitter @HathornSabin