Asia Pacific Markets Talking Points

- Stocks trade lower in Asia after disappointing US session

- Markets seem to be nervous ahead of the Powell testimony

- S&P 500 fall facing roadblock, net-short positioning rises

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Stocks traded mostly lower in Tuesday Asia Pacific trade, echoing the nervous behavior from the prior Wall Street trading session. Absent a major catalyst in a relatively quiet session, markets seemed to be anxiously awaiting this week’s testimony from Fed Chair Jerome Powell and the latest FOMC meeting minutes.

China’s Shanghai Composite, Australia’s ASX 200 and South Korea’s benchmark KOSPI declined about 0.6, 0.3 and 0.2 percent to the downside. Meanwhile, Japan’s Nikkei 225 was little changed. There, underperformance in information technology was balanced by a pickup in communication services.

A cautious decline in front-end US government bond yields signaled risk aversion to a certain degree and the haven currency of choice was the highly-liquid US Dollar. On the flip side of the spectrum, the pro-risk Australian Dollar underperformed, particularly against the anti-risk Japanese Yen.

S&P 500 futures remain pointed firmly lower, hinting at a continued deterioration in sentiment to come during European and US trading hours. Countering this performance is an uptick in net-short positioning for the index which is offering a bullish contrarian trading bias.

Join me every week on Wednesday’s at 00:00 GMT as I show you what market positioning is revealing about the prevailing trends in markets !

S&P 500 Technical Analysis

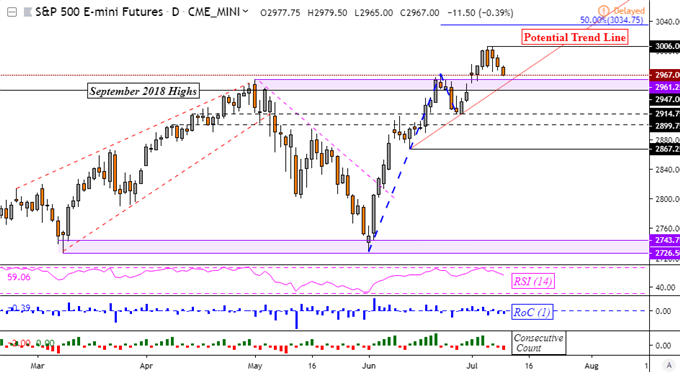

Amidst these competing signals, technical analysis shows that the S&P 500 could be heading for a roadblock ahead. What appears to be a potential rising trend line is aligned with former resistance which is a range between 2947 and 2961. If this area holds, there may be a retest of resistance at 3006.

S&P 500 Futures Daily Chart

Charts Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter