Crude Oil Price, Chart and Analysis:

- Crude oil’s short-term rally in a medium-term negative set-up.

- US-China trade talks and heightened US-Iran rhetoric will steer the price of oil.

The Brand New DailyFX Q2 2019 Trading Forecast and Guides are Available to Download Now!!

Crude Oil Pushes Back After US-China Talks Tweeted

Tuesday’s crude oil pull-back was fueled by talk that trade protagonists China and the US are set to resume talks next week, potentially easing trade war tensions that have weighed on the global economy over the last year. In a tweet, US President Donald Trump said that he had a ‘very good conversation with President Xi of China’ and that ‘we will be having an extended meeting next week at the G-20 in Japan’. The US-China trade war has frequently been cited as one of the main reasons that global growth has slowed, and any further positive language or action will continue to give oil an uplift.

The recent oil tanker attacks in the Gulf of Oman have heightened tensions between the US and Iran in recent days with the US yesterday announcing that they would be sending an additional 1,000 troops to the Middle East, fueling further concern of conflict with Iran. The Strait of Hormuz, a narrow stretch of water between the Persian Gulf and the Gulf of Oman is one of the most important oil trading routes with over 30% of liquified gas and around 20% of total global oil production passing the strait. Any further flashpoints in the area would push oil prices sharply higher.

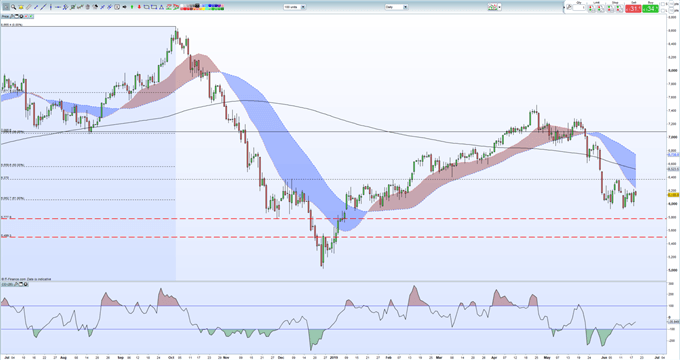

Oil currently trades around $61.30/bbl. and has bounced off the $59.20/bbl. area a couple of times already in the last two weeks. This area protects levels last seen in mid-January this year. There is a 61.8% Fibonacci retracement level at $60.63/bbl. which is currently in play and may slow down any further move lower. While the short-term outlook is mildly positive, oil remains under all three moving averages and needs to trade and close $63.70/bbl. to start to build bullish momentum. The 200-day moving average and the 50% Fibonacci retracement converge between $65.18/bbl. and $65.60/bbl.

How to Trade Crude Oil: Trading Tips and Strategies

Crude Oil Daily Price Chart (July 2018 – June 19, 2019)

IG Client Sentiment data shows how traders are positioned in a wide variety of asset classes and how daily and weekly shifts can affect market sentiment.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on crude oil – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.