Oil Price Analysis and News

- Risk Averse Environment Outweighing Supply Side Risks

- Hedge Funds have Scaled Back Bullish Oil Bets

- Backwardation May Put a Floor on Further Losses

Risk Averse Environment Outweighing Supply Side Risks

After posting the largest weekly drop in 2019, oil prices have extended on its losses amid the step up in trade war tensions sparking risk averse sentiment. Brent crude futures are down over 2% this morning with front month contract exacerbating losses after a breach below the 200DMA, which also coincided with the break of the $69/bbl level. Overnight, sentiment regarding trade tensions between the US and China did not appear to show notable signs of improving as reports emerged from China that they could potentially cut off rare earth exports to the US.

Hedge Funds have Scaled Back Bullish Oil Bets

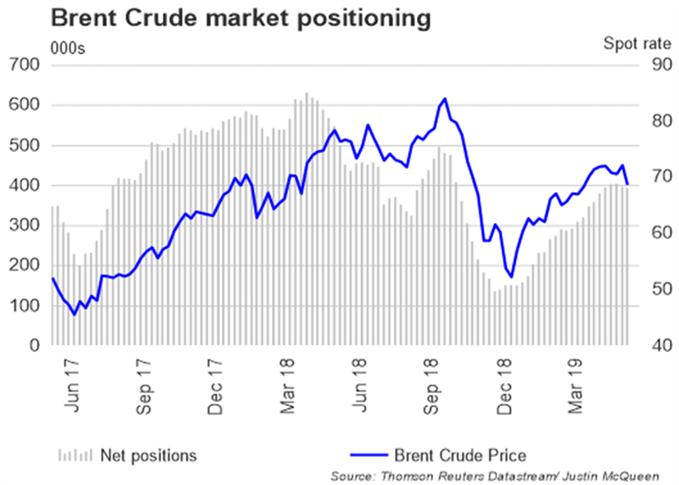

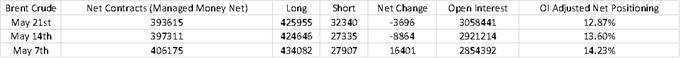

In light of the weaker economic environment, hedge funds have continued to scale back on their bullish positioning for Brent crude oil, which in turn has seen the ratio of long/short positions drop to 13:1 (Prev. 15.5:1). (COT Commodity report)

Backwardation May Put a Floor on Further Losses

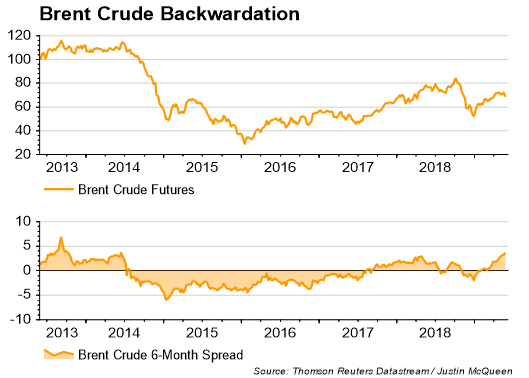

Despite the deteriorating economic outlook, fundamentally the Brent crude oil market remains tight with the 6-month spread in steep backwardation at $3.50, given that concerns over potential supply disruptions persist. As such, with this in mind, this could potentially curb further losses in Brent crude providing that the spread remains in steep backwardation.

What is Brent Crude Backwardation?

Looking Ahead

Moving forward, oil traders will look towards tonight’s API crude inventory report, scheduled for release at 2130BST ahead of tomorrow’s DoE crude report.

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Recommended Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX