Asia Pacifc Markets Talking Points

- US-China trade war fears fuel risk aversion in Thursday Asia trade

- The Nikkei 225 suffers with telecommunication shares as Yen gains

- Euro Stoxx 50 is at risk amidst European elections, eyeing support

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Top Asia Market Developments

Risk aversion characterized Thursday trade in Asia Pacific markets, echoing the cautious mood seen on Wall Street in the prior trading session. Fears of the US stepping up efforts to blacklist Chinese telecommunication and surveillance companies are fueling greater concern that US-China trade talks could head in the wrong direction.

In Japan, these fears could be seen reflected in the Nikkei 225 which traded about 0.7 percent lower. The nation’s benchmark index was weighed down by telecommunication companies, with shares of SoftBank Group down over 5.5%. Elsewhere, the Shanghai Composite and ASX 200 traded about 0.85 and 0.21 percent to the downside.

The uptick in risk aversion ended up benefiting the anti-risk Japanese Yen, as anticipated. On the flip side of the spectrum, the pro-risk Australian and New Zealand Dollars underperformed, with both currencies also being overshadowed by increasingly dovish RBA and RBNZ monetary policy expectations. The British Pound was also little lower given uncertainty to Brexit if UK Prime Minister Theresa May is ousted.

The Remaining 24 Hours

European indexes and the Euro are bracing for volatility as the first round of European Parliamentary elections begins. EUR/USD is vulnerable should a greater share of eurosceptic parties gain seats. Meanwhile, there will be a slew of Eurozone PMIs that will offer a gauge of economic performance in the regional bloc. Regional data is still tending to underperform, more of the same could sour sentiment.

Euro Stoxx 50 Technical Analysis

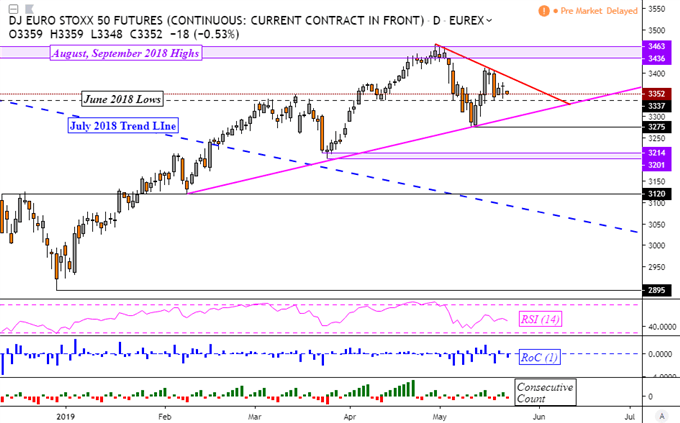

S&P 500 futures are pointing lower, hinting that risk aversion may continue through the remaining 24 hours. Taking a look at Euro Stoxx 50 futures, to show after-hours trade, they could soon find themselves testing the rising support line from February on the chart below now that we are aiming lower after a retest of the descending resistance line from late April.

Euro Stoxx 50 Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter