Asia Pacific Market Open Talking Points

- Canadian Dollar weakened as crude oil price fall fueled BoC rate cut bets

- British Pound weakened on Brexit uncertainty, is Theresa May done for?

- Risk of US-China trade war still an overhang for equities, Yen may gain

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

Canadian Dollar Sinks with Crude Oil Despite Solid Retail Sales Data

The Canadian Dollar brushed aside solid local retail sales data, underperforming against most of its major counterparts on Wednesday. Excluding automotive, companies sold 1.7% more m/m in March versus 0.9% expected and from 0.7% in February. That was the highest since May 2018, but once you accounted for autos, those only rose 1.1% versus 1.2% anticipated. Bank of Canada rate cut bets actually increased by day-end.

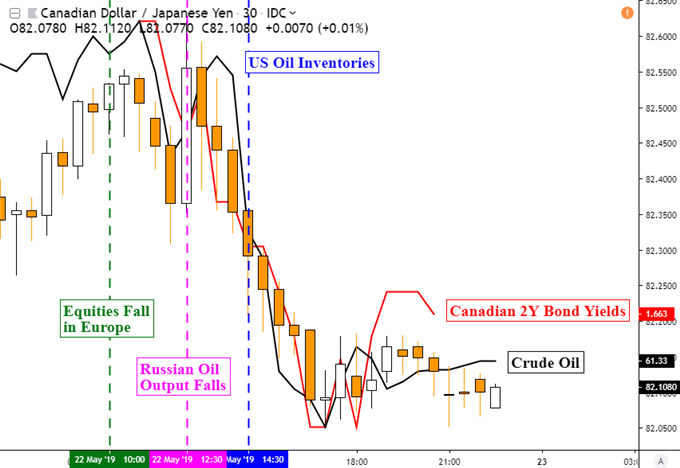

Moreover, the Loonie was focused on what was going on with the decline in crude oil prices. It began with a downturn in sentiment during European hours as equities fell. The commodity brushed aside a drop in Russian oil output, which highlights its vulnerability to a decline in stocks due to its sentiment-linked vulnerability. The commodity did also accelerate its decline when US weekly oil inventories increased.

CAD/JPY Versus Crude Oil Prices and Canadian Bond Yields

Chart Created in TradignView

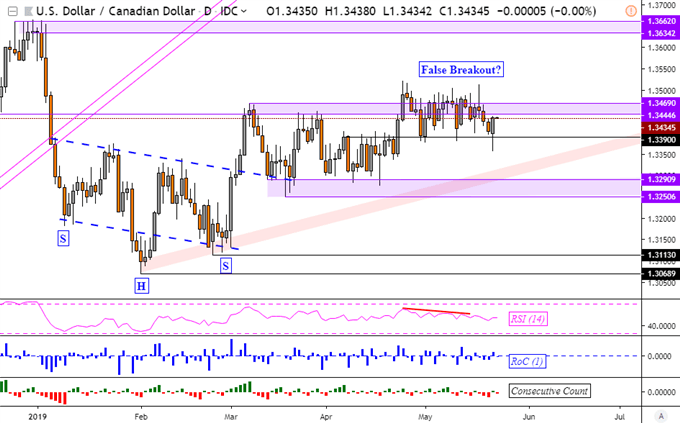

Canadian Dollar Technical Analysis

USD/CAD finds itself wedged between support at 1.3390 and resistance just under 1.3445. The pair struggled to breakout to the upside over the past three weeks when looking at its performance around the peaks in March. A break under support exposes what could be a rising channel of support from February lows.

USD/CAD Daily Chart

Chart Created in TradingView

British Pound, Brexit, FOMC Minutes and the US Dollar

The British Pound continued to depreciate across the board in its prolonged decline since earlier this month over the future of Brexit. Over the past 24 hours, UK Prime Minister Theresa May came under increasingly more pressure to step down which risks throwing another curveball at EU-UK divorce negotiations. Meanwhile, the US Dollar traded sideways as the FOMC minutes stressed the importance of local data.

Thursday’s Asia Pacific Trading Session

S&P 500 futures are pointing narrowly lower heading into Thursday’s session following a disappointing day on Wall Street. Overnight, the US weighed blacklisting Chinese surveillance firms such as Megvii and Meiya Pico. If this risks escalating US-China trade wars after talks have reportedly been stalling, equities could be vulnerable with the anti-risk Japanese Yen in a potentially good spot to benefit from.

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter