Oil Fundamental Forecast: Bearish

- Crude oil prices rose as US delayed auto tariffs, the S&P 500 climbed

- Oil gains on OPEC+ meeting, where Iran will be absent, may be offset

- Risks to crude oil are trade wars, FOMC minutes and client positioning

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

Crude Oil Prices Wrap

Crude oil prices spent most of last week recovering from the near-term downtrend since late April, at one point rising nearly 4 percent. This occurred amidst the backdrop of cooled US-China trade tensions and rosy earnings from Walmart and Cisco on Thursday which sent the sentiment-linked commodity higher alongside the S&P 500. Oil also briefly enjoyed that the US delayed a decision to impose auto tariffs.

OPEC+ Meeting and Oil Supply Disruption Concerns

Before the new week even begins, crude oil prices may face supply-related volatility in the aftermath of this weekend’s OPEC+ Joint Ministerial Monitoring Committee. As a reminder, the oil-producing cartel has been taking measures to reduce output and uphold the commodity. Members, excluding Iran, will be meeting in Jeddah, Saudi Arabia, to monitor the status of meeting their targets.

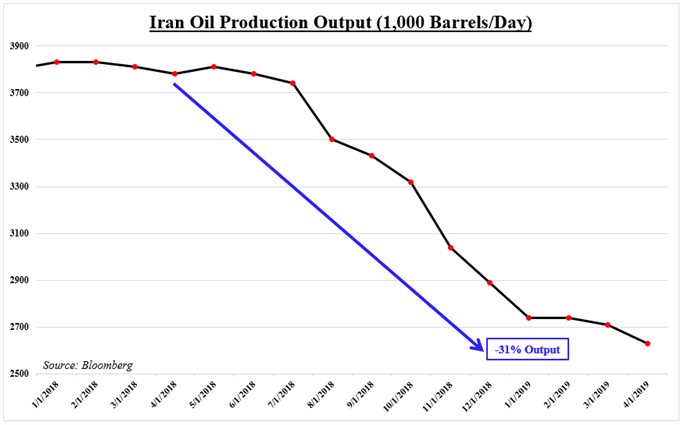

Iran has been excluded amidst geopolitical tensions between it and the United States. US President Donald Trump has financially sanctioned the nation and countries that purchase oil from it. This risks sending prices higher on supply-disruption concerns. On the chart below, Iranian oil production has declined over 30% since last year and will likely continue plummeting.

This raises the question of whether or not OPEC will address a larger-than-expected shortfall in output. If it doesn’t, this risks increasing tensions with the US given how frequently Mr Trump expresses displeasure with higher prices while domestic production runs high. As such, gains for oil to be had in the aftermath of the meeting can be offset. For timely updates on oil, you may follow me on Twitter @ddubrovskyFX.

Iran Oil Output Falling

Trade War Fears and FOMC Minutes

The sentiment-linked commodity also is vulnerable to an escalation in US-China trade wars which poses a risk to global growth and the demand for oil. Not to mention that when it comes to the US sanctions on Iran, China has openly expressed how it is opposed to them. As such, if China were to continue purchasing oil from Iran, this may put trade talks in an awkward spot.

Towards the end of last week, oil paused its rally and the S&P 500 fell on reports from CNBC that talks between the two nations stalled. Do also watch the FOMC meeting minutes, which may reiterate the central bank’s neutral stance on interest rates. Given that markets are still highly anticipating a cut by year-end, a reduction in rate cut bets may sink the S&P 500 and take crude oil down with it.

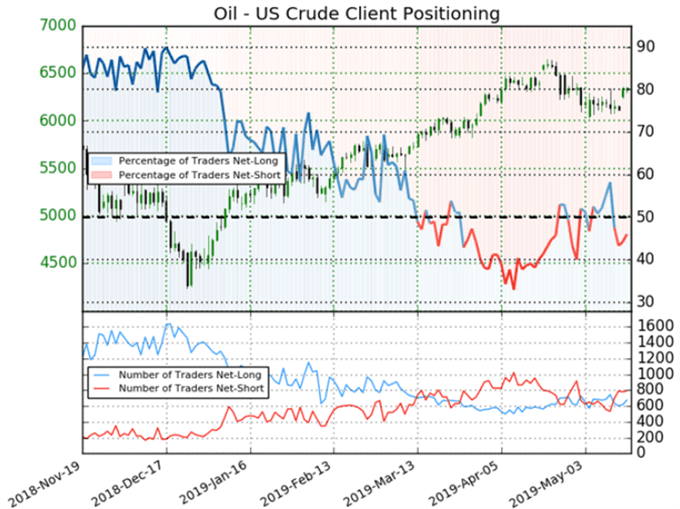

Crude Oil Client Positioning

Since early April, there has been a decrease in overall net-short trader positioning in crude oil on the next chart below. Since then, prices have dropped over 5 percent amidst these bearish-contrarian price signals. An increase in net-long positioning poses as a downside risk to the commodity. To learn more about using this in your market analysis, tune in for my webinars each week on Wednesdays at 00:00 GMT.

Data Provided by IG

Oil Trading Resources:

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our free guide to learn what are the long-term forces driving oil prices

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Looking for a technical perspective on Equities? Check out the Weekly Oil Technical Forecast