MARKET DEVELOPMENT –USDCAD Breakout, GBPUSD Selling Persists, EURGBP on Record Win Streak

DailyFX Q2 2019 FX Trading Forecasts

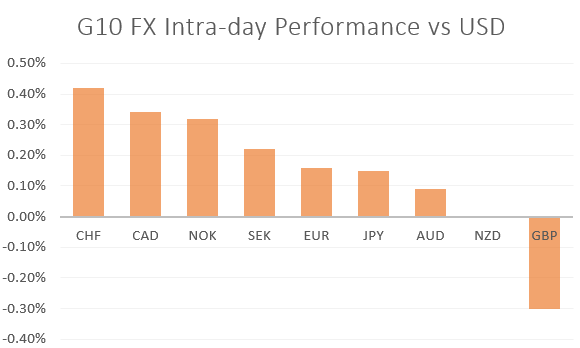

GBP: The outlook for the Pound remains soft, a break below 1.2670 sees GBPUSD at the lowest level since the beginning of January. With little end in sight regarding the political uncertainty at Downing Street, GBPUSD looks set to drift lower, in which a close below 1.2670 raises the risk of a move south of the 1.26 handle. UK CPI rose to the highest level this year, stemming from energy price hikes, however, the figures had been softer than expectations, reaffirming the case that the BoE are unlikely to hike this year.

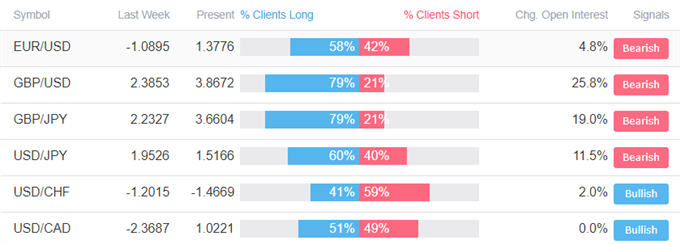

EUR: Cross-related buying in EURGBP continues to keep the Euro elevated, eyes are on for a test of resistance at 0.8838, which could provide a temporary halt to the advances in the cross. EURUSD remains consolidated within the 1.11-1.12 range for now. However, less dovish FOMC minutes and tomorrow’s soft EZ PMIs could see Euro test lower levels. Support at 1.1135-40 and 1.1112.

CAD: The Canadian Dollar is notably firmer this morning after the better than expected retail sales data, which provides another reminder that the Canadian economy remains resilient. Consequently, the Citi Economic Canadian Surprise Index is now at the highest level since Q1 2018. Alongside this, tighter US/CA yield spreads have also keep the Loonie supported. Reminder, DailyFX, IG Trade Idea, Bearish AUDCAD (from May 17th)

Source: DailyFX, Thomson Reuters

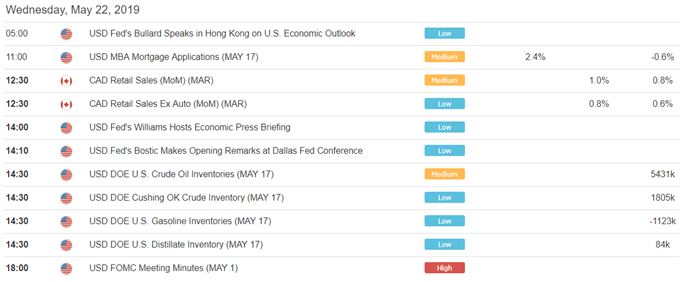

DailyFX Economic Calendar: – North American Releases

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Crude Oil Price Eyeing Break of Near-Term Technical Support” by Nick Cawley, Market Analyst

- “USD Bulls Eye Return to 2019 Highs on FOMC Minutes” by Justin McQueen, Market Analyst

- “Dow Jones, US & UK Crude Oil, Silver Price Charts & More” by Paul Robinson, Currency Strategist

- “GBPUSD Price May Yet Drop More as UK Inflation Data, Brexit Sour Mood” by Martin Essex, MSTA, Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX