EURGBP Price Outlook:

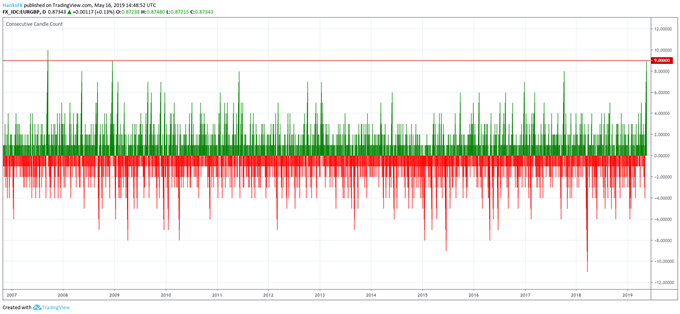

- The 9-day climb for EURGBP is the longest for the pair since late 2008

- The pair has pressed to 3-month highs as Sterling continues to weaken

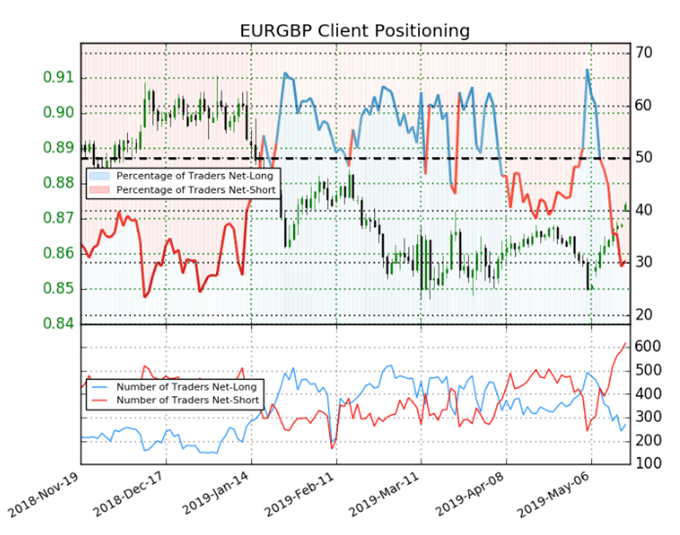

- Despite the streak, retail traders remain net short EURGBP. Find out how to use IG Client Sentiment Data with one of our Live Sentiment Data Walkthroughs

EURGBP Extends Winning Streak as Brexit Uncertainty Weighs

On the back of renewed Brexit uncertainty, EURGBP has staged an incredible rally over the last 9 trading days, surging from 0.8492 to 0.8748. The streak is the longest for EURGBP since the end of 2008 when the pair matched the current run. Beyond that, there has only been one bullish streak longer than 9 sessions since 1999, a 10-day rally in September 2007.

EURGBP Consecutive Candle Count, Daily (Chart 1)

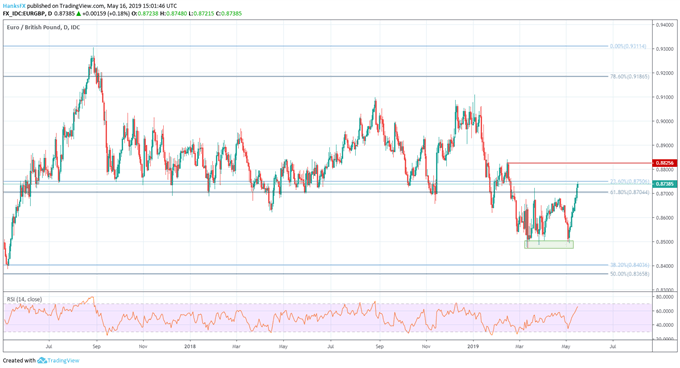

In Thursday’s session, the pair has backed off 0.8750 after probing the 23.6% Fib retracement from July 2015 lows to August 2017 highs. Coupled with technical resistance, Theresa May has reportedly said she will set her timeline to stepdown from her position in June. With a concrete date, Sterling may see a brief reprieve as it slides against most counterparts. That said, retail clients remain overwhelmingly short EURGBP – despite the considerable rally to 3-month highs.

EURGBP Price Chart: Daily Time Frame (June 2017 – May 2019) (Chart 2)

Retail trader data shows 30.4% of traders are net-long with the ratio of traders short to long at 2.29 to 1. The number of traders net-long is 15.1% lower than yesterday and 38.6% lower from last week, while the number of traders net-short is 3.0% higher than yesterday and 45.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURGBP prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURGBP-bullish contrarian trading bias.

EURGBP IG Client Positioning (Chart 3)

IG clients have been net-short the pair during the latter half of the streak as they attempt to call the top. To learn more about sentiment data and how to use it in your trading, sign up for my sentiment walkthrough webinar later today. Aside from the bullish contrarian signal, persistent uncertainty around Brexit will continue to erode confidence in the Pound as the Euro looks to add to its streak.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: GBP/JPY Price Outlook: Further Bearish Momentum Hints at 139.00

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.