USDJPY Price Outlook:

- Disappointing data from the retail and industrial sectors worked in tandem to weigh on the economic outlook for the United States

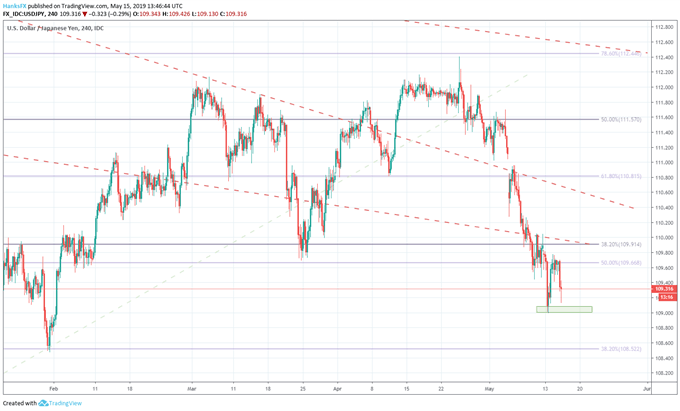

- In turn, USDJPY probed monthly lows slightly above 109

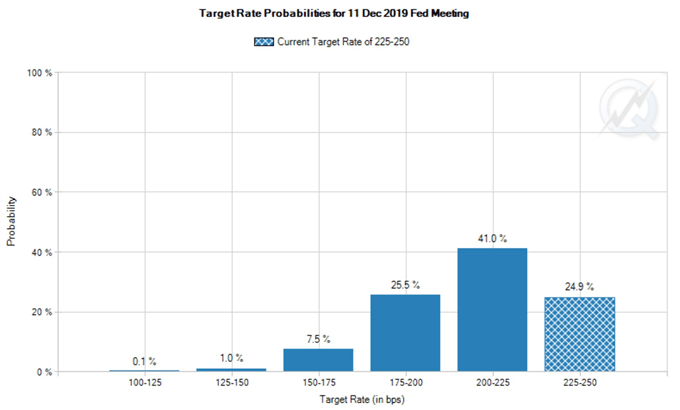

- 2-year Treasury yields slip to their lowest since February 2018 as the odds of a rate cut mount

USDJPY Probes Monthly Lows on Disappointing US Data

April retail sales and industrial production data disappointed Wednesday morning, shattering optimism regarding a potential rebound in retail data after April’s print came in -0.4% beneath expectations, -0.2% versus 0.2%. Industrial production data was similarly disappointing, -0.5% versus 0.0% expected. Consequently, the odds of a rate cut have soared, and the Fed’s policy path remains a major trading theme to watch. In turn, USDJPY traded near monthly lows and the 2-year US Treasury yield slipped to the lowest since February 2018.

CME Fed Watch Tool

Source: CME

USDJPY Probes Monthly Lows

USDJPY was narrowly above monthly lows around 109.02 after retracing Tuesday’s bullish move which tested the 50% Fibonacci level around 109.67. Should USD weakness persist and send the pair beneath 109, the door opens for a continued move lower – possibly to the 38.2% Fib level at 108.52. With an uncertain outlook for US economic growth and rising probability of a rate cut from the Federal Reserve, continued USD weakness versus the Yen appears likely for the time being.

USDJPY Price Chart: 4 - Hour Time Frame (February 2019 – May 2019) (Chart 1)

Bonds Rise, Yields Falter

As the demand for safety increased, 2-year US Treasury yields slipped to their lowest since February 2018 – around 2.15%. Faltering yields also resulted in a re-inversion of the 10-year and 3-month yield curves. That said, the more widely-watched 3m5s and 2s10s have yet to invert. Still, Treasury yields will remain a widespread concern for investors as they have in the past.

View A Brief History of Trade Wars to read about the precedents set in prior economic conflicts.

Upon the initial inversion in March, recession fears were heightened and many investors warned of a stock market crash. Since then, such fears have calmed, but another inversion and a reignited US-China trade war could work to weigh on investor sentiment once more.

USDCNH: Why 7.00 is the Spot to Watch in the US-China Trade War

US 2-Year Treasury Yield Chart: Daily Time Frame (February 2018 – May 2019) (Chart 2)

3-month, 10-year yield inversion overlaid in red

That said, optimism may outweigh fear in the interim as President Trump announced a delay on imposing auto tariffs on the European Union. In response, USDJPY has retraced much of its earlier weakness alongside a early-morning recovery rally in US stocks.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: S&P 500 Outlook: ETF Flows Suggest Flight to Currency Market

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.