SEK, NOK TALKING POINTS – EUROPEAN GROWTH, SEK, NOK

- NOK, SEK cautiously wait for Eurozone GDP, Italian data

- German GDP in particular will be heavily eyed by Nordics

- Swedish CPI leaves Krona unimpressed – Ingves speaks

See our free guide to learn how to use economic news in your trading strategy !

As we head into Europe’s trading hours, the Swedish Krona and Norwegian Krone may find themselves under pressure ahead of Eurozone GDP data and Italian industrial production. Nordic traders – particularly those with exposure to SEK crosses – will be closely watching German GDP. Last month Riksbank Deputy Governor Martin Floden expressed concern about growth prospects in the largest Eurozone economy.

Italian industrial production will also catch the attention of global investors following the country’s recent ascension out of a shallow recession. However, this has not stopped Italian 10-year bond yields from rising amid growing concerns that the government’s budget deficit and growth prospects may push the economy off a cliff. Adding to the risk are the upcoming European Parliamentary elections that are bound to shake the EU.

On May 14, Swedish CPI data came in – an almost miraculous way – exactly in line with analysts’ forecasts. It appears they have adjusted their outlook to properly reflect the current economic conditions and shifted away from a model that was overly optimistic. The Krona rose against all its major counterparts and was a key influencer in causing USD/SEK to close in the red.

This was followed by a cheerful response from Riksbank Governor – well, as joyful as a central banker can get – Stefan Ingves who welcomed the price growth data but reiterated that expansionary policy will need to remain in order to continue supporting inflationary pressure. Overnight index swaps after CPI was released showed traders were betting on a marginally higher probability of a hike over a cut.

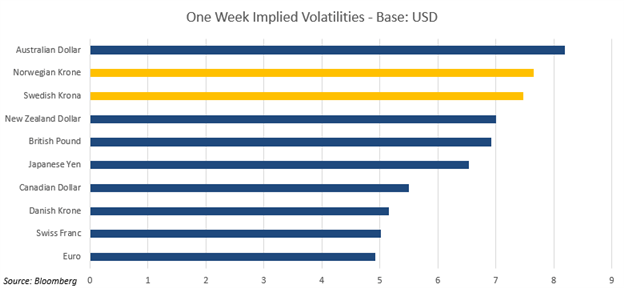

Looking ahead, global fundamental themes will continue to be a major driver of Swedish Krona and Norwegian Krone price action. This will be particularly true for the oil-linked NOK and OBX index that are frequently torn between oscillations in global sentiment. This might explain why one-week implied volatilities in G10 currencies against the USD are the second and thirst highest in the Krone and Krona, respectively.

Chart of the day: NORDIC FX AMONG MOST VOLATILE OF G10

NORDIC TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter