Asia Pacific Markets Wrap Talking Points

- Asia markets gap lower, but attempts to trim losses fall short as Nikkei 225 declines

- US President Donald Trump optimistic of trade deal, anti-risk Japanese Yen lower

- Euro Stoxx 50 may rise on regional sentiment data, but FTSE 100 looking vulnerable

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Key Asia Market Developments

Asia Pacific markets could be characterized by partial retracement, even though most benchmark indexes pointed to a loss on Tuesday. For the Nikkei 225, the day began with a downside gap amidst rising concerns over an escalation in US-China trade wars which have recently taken a turn for the worst. It was particularly weighed down by communication services, with SoftBank Group Corp. shares down over 4.5%.

However, most regional bourses, after gapping lower, traded to the upside in the ensuing hours. It just wasn’t enough to entirely close their gaps. A dose of optimism could be traced to recent commentary from US President Donald Trump. Early into the session, he expressed optimism that a deal with China could be reached and we may know about it in 3-4 weeks.

Looking at foreign exchange markets showed signs of ‘risk on’ trade. The sentiment-linked Australian and New Zealand Dollars aimed narrowly higher. The worst-performing major was the anti-risk Japanese Yen. Looking at South Korea’s benchmark KOSPI showed gains of over 0.3%, boosted by Samsung Electronics (+0.47%). Still, China’s Shanghai’s Composite Index was down over 0.35%. Australia’s ASX 200 fell.

The Remaining 24 Hours

S&P 500 futures are now pointing higher, suggesting that European and US markets may be heading for a pause in their recent declines. German and Eurozone sentiment data will be closely watched by the Euro Stoxx 50. Recently, European economics news flow has been tending to improve relative to economists’ expectations. A rosy outcome may further cool the anxiety in traders.

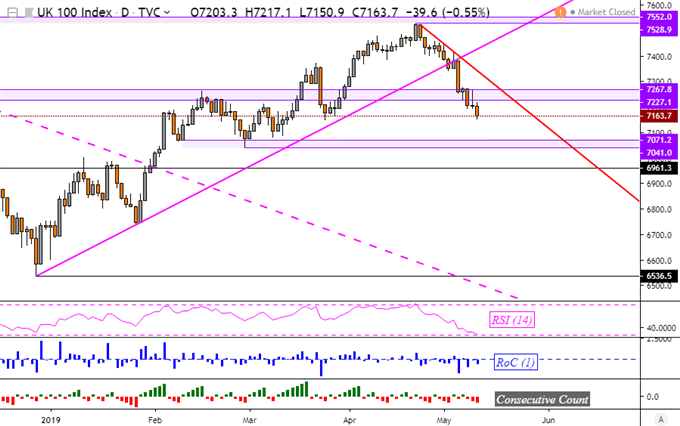

FTSE 100 Technical Analysis

The FTSE 100 has just recently broken under a key support level around 7227, continuing its downtrend from the middle of April. This also follows the descent through the rising trend line from the beginning of this year. With that in mind, we may be aiming for near-term support in the medium-term which is a range between 7041 and 7071. This is also further supported by a bearish-contrarian FTSE 100 trading bias.

Want to learn more about how sentiment readings may drive the FTSE 100 and various other equities? Tune in each week for live sessions as I cover how sentiment can be used to identify prevailing market trends !

FTSE 100 Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter