Oil Price Analysis and News

- US Crude Oil Supply Continues to Rise

- Saudi Arabia supplying more to Asia

US Crude Oil Supply Continues to Rise

Brent crude futures broke through the $70 handle amid the continued deterioration in risk sentiment stemming from rising trade war tensions, while supply side risks have also kept prices under pressure. Yesterday saw the release of the weekly API crude inventory report, which showed a larger than expected build at 2.81mln (Exp. 1.2mln). Eyes will now turn towards the DoE report, in which expectations are for a build of 1.2mln. Elsewhere, the EIA had raised its forecast on US crude production to rise by 1.49mbpd in 2019 from 1.43mbpd, while also sees the US producing at an average of 13.38mbpd. As a reminder, last week saw US crude production hit a record high of 12.3mbpd.

Saudi Arabia supplying more to Asia

Another bearish development for oil prices had been Saudi Arabia’s announcement that they will increase supply to Asia in order to compensate for loss of Iranian barrels of crude. As such, with enough spare capacity for Saudi Arabia to compensate, questions will be raised as to whether OPEC will relax oil quota’s due to the waning oil supply from both Iran and Venezuela.

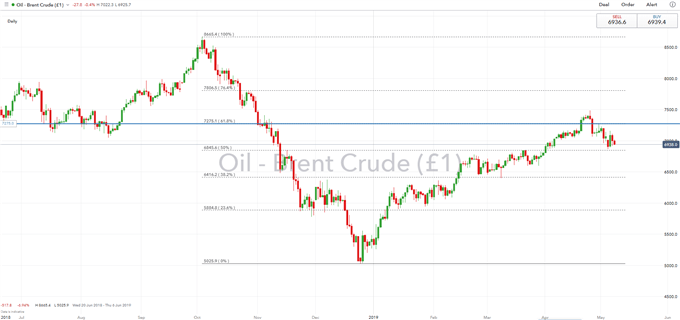

Crude Oil Technical Analysis

As Brent crude trades south of the $70 handle, eyes are on for a move towards $69.20, in which a break below opens up for a test of $68.45, which marks the 50% Fibonacci retracement of the 2018 high to 2018 low. Topside resistance is situated at $70.

Brent Crude Price: Daily Timeframe (Jun 2018 – May 2019)

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Recommended Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX