MARKET DEVELOPMENT – USD Supported on Global Risk Aversion, EUR & GBP Drops

DailyFX Q2 2019 FX Trading Forecasts

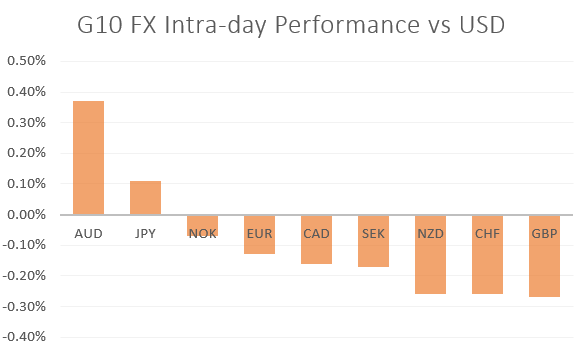

AUD: The Australian Dollar outperforms this morning, benefitting from a short squeeze after the RBA maintained interest rates at 1.5%. Heading into the meeting, markets had been 50/50 on whether the central bank would deliver a 25bps cut or not, as such, the decision not to saw the Australian Dollar spike higher in reaction. However, gains have been faded given that the RBA has left the door open to lower interest rates (rising unemployment rate needed), while the growing trade tensions between the US and China amid Trump’s tweet has also capped Aussie upside, eyes on support at 0.70. Despite this however, Chinese Officials will meet their US counterparts in the hope of reaching an agreement. Base case remains that a deal between the US and China will be reached.

GBP: The Pound is on the backfoot having pared some of Friday’s rally. Consequently, GBPUSD trades south 1.31, eyes remain firmly fixed on the outcome of the cross-party talks, as such, there is headline risk to GBP. While Sterling risk reversals have flipped to positive in recent sessions (greater demand for GBP calls over puts), failure to yield an agreement could see GBPUD back below 1.30.

USD: Global risk aversion has seen investors flock to the safety of the greenback with the index gaining against its counterparts. Subsequently, this has seen the Euro below 1.12 with the currency also taking a hit from downgraded Eurozone growth forecasts and most notably upgrades to Italy’s debt forecasts.

TRY: The Turkish Lira extend its losses with USDTRY skyrocketing through the 6.00 handle after President Erdogan called for a re-run of the Istanbul election. As such, with the political and economic environment continuing to deteriorate, risks remain titled to the upside for USDTRY.

Source: Thomson Reuters, DailyFX

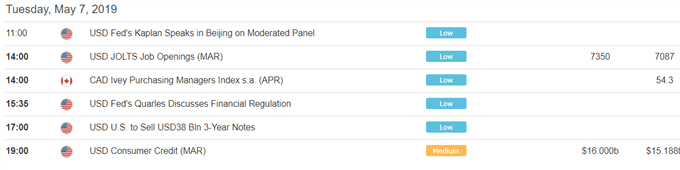

DailyFX Economic Calendar: – North American Releases

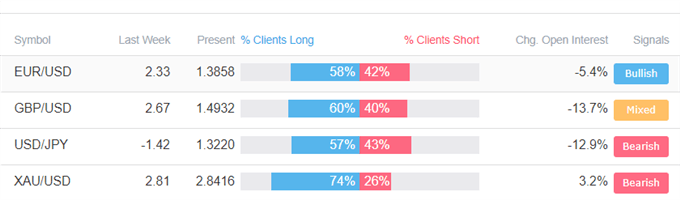

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “FTSE Technical Outlook – Breaking Trend Support, March Swing-high” by Paul Robinson, Currency Strategist

- “Gold Price Nudging Support, Silver Price Hitting Technical Resistance” by Nick Cawley, Market Analyst

- “COT Report: USD Bullish Bets at Multi-Year Highs, NZDUSD Net Shorts Doubled” by Justin McQueen, Market Analyst

- “GBPUSD Price Outlook Poor on Brexit Talks Pessimism” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX