USD CURRENCY VOLATILITY – TALKING POINTS:

- Overnight implied volatility metrics for major USD currency pairs leaps ahead of Friday’s US GDP data release which may potentially stoke a sizable market reaction

- The DXY US Dollar Index recently surged above technical resistance to its highest level since May 2017 and could suggest USD traders are expecting tomorrow’s GDP numbers to beat estimates

- Take a look at this article for information on How to Trade the Top 10 Most Volatile Currency Pairs or download the free DailyFX Q2 USD Forecast for comprehensive fundamental and technical insight on the US Dollar over the second quarter

Forex traders are starting to see signs that currency volatility could be ticking higher, led by the latest surge in the US Dollar. In fact, recent USD gains has pushed the DXY US Dollar Index above key resistance at the 98.00 price level which is its highest reading in nearly 2 years.

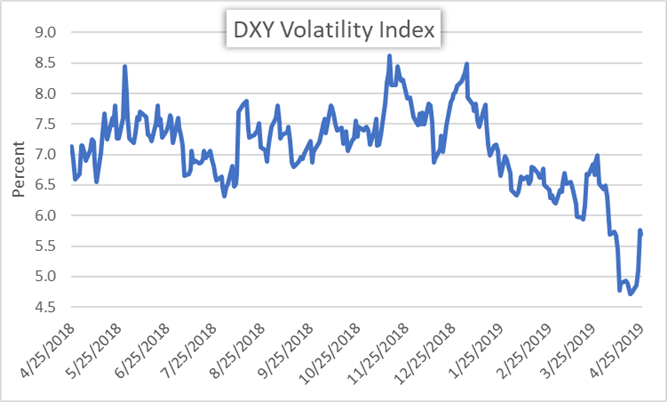

DXY US DOLLAR INDEX 1-MONTH IMPLIED VOLATILITY PRICE CHART: DAILY TIME FRAME (APRIL 24, 2018 TO APRIL 25, 2019)

Prior to the greenback’s latest advance, forex market volatility was seemingly evaporating. But, price action looks to be picking up again judging by rising implied volatility which interestingly aligns with tomorrow’s potentially market-moving economic data.

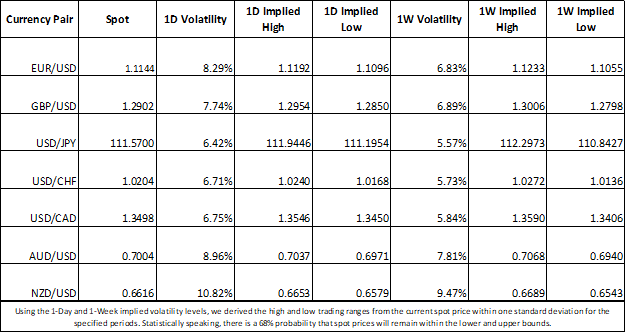

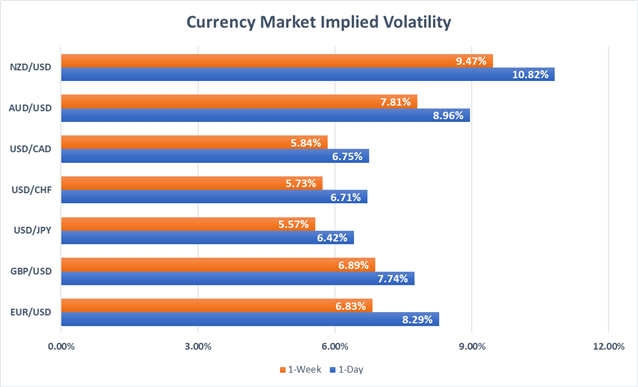

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

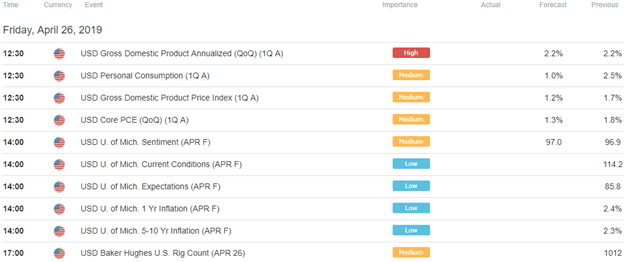

Performance in the major USD crosses tomorrow will largely depend on how closely actual Q1 US GDP is reported to consensus. Fed funds futures are currently pricing a 45 percent probability that the Fed will cut interest rates by its December 11 FOMC meeting.

If economic growth comes in above the 2.2 percent estimate, the odds that the Fed lowers its benchmark interest rate will likely drop which usually lifts the US Dollar. On the other hand, if GDP crosses the wires below forecast, markets could begin pricing in a higher likelihood that the Fed cuts rates this year.

FOREX ECONOMIC CALENDAR – USD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Currency pairs of interest highlights EURUSD, USDJPY and AUDUSD. Greenback gains could be limited against the Euro if GDP surprises to the upside considering recent EURUSD price action. On the other hand, there could be more room for the USD to run against the Aussie considering weak inflation out of Australia likely sets up the RBA for a rate cut.

Also, a US GDP beat would likely enhance risk appetite and send traders flocking out of anti-risk currencies like the Japanese Yen, especially given the BOJ’s reiterated dovishness. That being said, JPY could see a boost from US GDP coming in below estimates, particularly if the report is bleak enough to reignite market pessimism and flight to ‘safe-haven’ securities.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter