Currency Volatility EURUSD Talking Points

- King Dollar Breathes Life into FX Volatility

- Further Losses in Euro on the Horizon

Top 10 most volatile currency pairs and how to trade them

For a more in-depth analysis on FX, check out the Q2 FX Forecast

King Dollar Breathes Life into FX Volatility

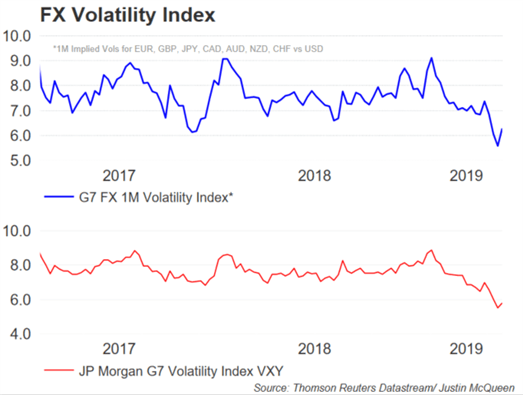

As investors remain on the hunt for yield, the USD has been among the major beneficiaries with the greenback making a topside break out of its multi-month range to reach its highest level since May 2017. Consequently, this looks to have breathed life into FX volatility with the 1-month implied volatility among G7 currencies appearing to have bottomed out from its multi-year lows.

Source: Thomson Reuters, DailyFX

Further Losses in Euro on the Horizon

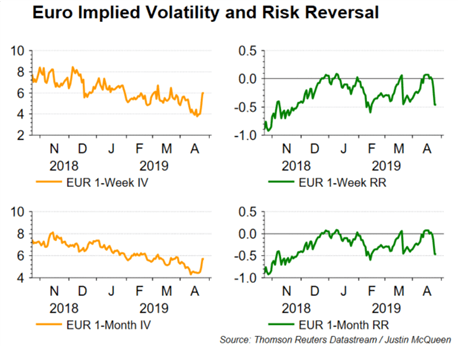

EURUSD: Following the topside breach in the USD index, the Euro made a decisive break below 1.1176 to post a fresh 22-month low. Data out of the Eurozone has continued to disappoint with last week’s PMI’s and this week’s German IFO failing to show a much needed rebound in the Eurozone economy. Consequently, the outlook remains a bleak one and with EURUSD breaking out of its narrow range, investors are now seeking downside protection, suggesting further losses are in store for the Euro, raising the prospect that EURUSD could see a 1.10 handle. As a reminder, the latest COT report, highlighted that speculators remain very bearish on the Euro with net shorts totalling $13.8bln.

Today’s Option Expiries: 1.1140 (800mln), 1.1170-75 (850mln), 1.1200 (700mln).

Source: Thomson Reuters, DailyFX

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX