AUDJPY IMPLIED VOLATILITY – TALKING POINTS

- AUDJPY 1-week implied volatility has collapsed to 7 percent from 16 percent at the beginning of 2019

- As currency volatility evaporates from the forex market, AUDJPY has recorded healthy advances together with gains in risk assets so far this year

- Check out this article for information on the Top 10 Most Volatile Currency Pairs and How to Trade Them

- Download the free DailyFX Trading Forecasts for comprehensive outlook US Dollar and Japanese Yen for the second quarter

The Australian Dollar has appreciated meaningfully against the Japanese Yen so far this year as recovering market sentiment and cratering volatility have supported ‘risky’ currencies such as the Kiwi relative to ‘safe-haven’ counterparts like the Yen.

In fact, AUDJPY has inked year-to-date spot returns in excess of 5 percent while the currency pair’s 1-week implied volatility has dropped from 16 percent to 7 percent at the same time.

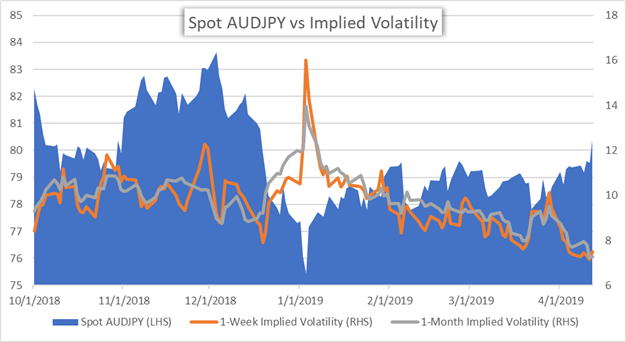

AUDJPY IMPLIED VOLATILITY PRICE CHART: DAILY TIME FRAME (OCTOBER 01, 2018 TO APRIL 12, 2019)

Moreover, AUDJPY 1-month implied volatility now sits at its lowest level in over a year. Aussie-Yen implied volatility has been on a steady decline since the Japanese Yen Flash Crash back in early January.

Subsequent to this event, AUDJPY has mirrored the rise in global equities with investor concerns over the slowing global growth getting pushed to the back seat following dovish monetary policy from central banks around the world aiming to restore market confidence. The Kiwi also received positive attention as the US-China Trade War progressively deescalated.

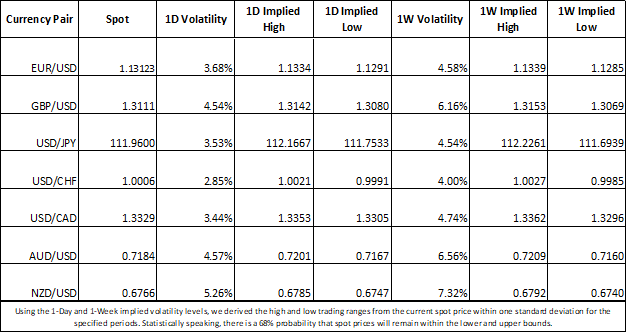

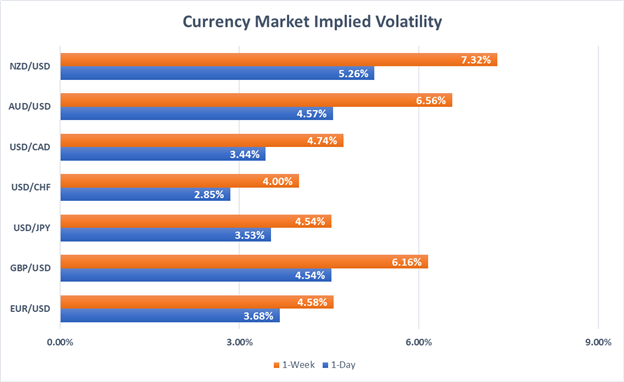

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Collapsing currency market implied volatility is not isolated to AUDJPY and has impacted several major currency pairs. While forex traders typically fiend for market volatility, the lack thereof has increased the relative attractiveness for currency carry trades.

Consequently, the demand for traders to go long high-yielding currencies like the Australian Dollar and take a short position on low-yielding currencies like the Japanese Yen has likely contributed to the strong advance of AUDJPY.

Furthermore, the Deutsche Bank G10 Currency Carry Trade Index has gained roughly 4 percent so far this year which outperforms spot returns across the major currency pairs. If volatility across markets continues to fall, the carry trade and risk assets could keep rising as a result.

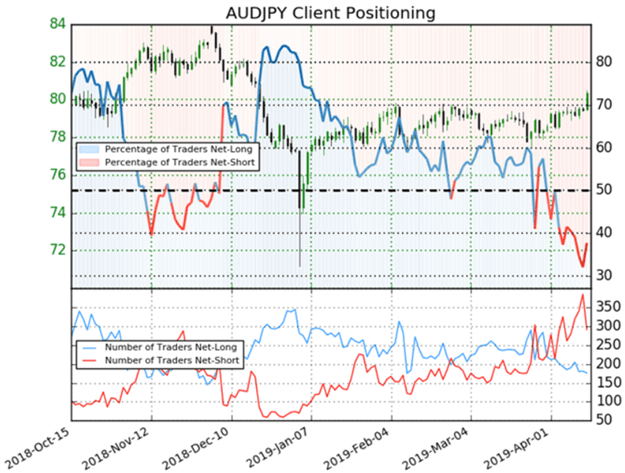

AUDJPY TRADER CLIENT SENTIMENT

Check out IG’s Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter