Oil Price Analysis and News

- Crude Oil Bulls Remain in Control

- Overtightening Oil Market Possible in Q2

- Green Shoots in China

Crude Oil Bulls Remain in Control

As mentioned earlier this week, the rising geopolitical premium from fighting in Libya continues to provide underlying support for oil prices. The NOC Chief provided another reminder that the situation could get a lot worse, after stating that renewed fighting could wipe out Libya’s crude production. As a reminder, in the latest OPEC monthly report, Libya were said to be producing at 1mbpd. As such, an escalation in tensions can provide enough fuel to propel oil prices higher. Elsewhere, oil waivers we be increasingly looked at ahead of the May 5th deadline. While Trump may want lower prices, he also wants to tighten his grip on Iran, which in turn could see Trump extend oil waivers to several nations (China, India, Japan, South Korea) however, the amount that can be purchased could be reduced. Nonetheless, the tensions between Iran and US will continue to add to the geopolitical premium in crude oil and thus keep oil supported.

Overtightening Oil Market Possible in Q2

This week, the saw the IEA show that OECD oil stocks in February saw a sizeable decline, in which inventories are estimated closing he month at roughly 16mbpd above the 5-year average. This is important given that this is what OPEC and Non-OPEC members use in order to gauge the state of the market balance. Consequently, given the involuntary plunge in crude production from the likes of Venezuela. There is a risk that the oil market may over tighten in Q2.

Green Shoots in China

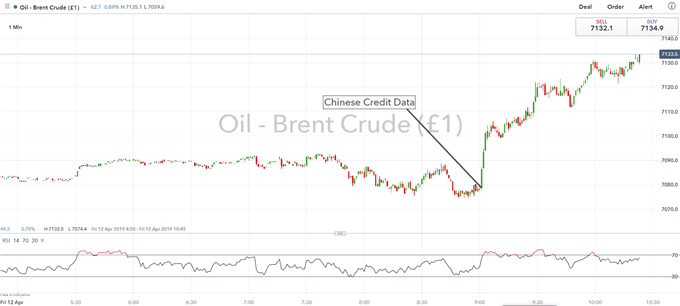

On the macro front, this morning’s trade balance data out of China adds to the growing view that the country could soon begin to recover. China reported a notably larger than expected surplus as exports surged. Elsewhere, Chinese credit data surprised to the upside, sparking a fresh bid in the risk sentiment with Brent crude futures up 0.8%, while the S&P 500 hovers around 2900.

BRENT CRUDE OIL DAILY TIME FRAME (AUG 2018 – APR 2019)

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

More Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX