TALKING POINTS – BREXIT DEAL, MONETARY POLICY, ECB RATE DECISION, FOMC

- ECB, FOMC, Brexit main focus for NOK, SEK, global markets

- How will slower European growth impact Nordic economies?

- Norway CPI could be overshadowed by external event risks

See our free guide to learn how to use economic news in your trading strategy !

Global markets are in for a volatile day over the remaining 24 hours. The FOMC is preparing to release its meeting minutes, the ECB is announcing its next rate decision with commentary by Mario Draghi, and the EU’s verdict on granting the UK government a Brexit extension is due. Because of the global impact from all of these potential market-disrupting factors, local Nordic data may as a result be overshadowed due to the focus on external event risks.

The release of the FOMC meeting minutes will reveal the Fed’s outlook for monetary policy going forward, and what some of the board members’ outlook is for global growth and how the central bank intends to respond. As outlined in my weekly Nordic fundamental outlook, if policymakers’ forecasts are adequately pessimistic enough for them to believe a cut is warranted, it could result in a substantial amount of volatility.

The ECB will be releasing its interest rate decision with policymakers anticipating a hold, though commentary from Mario Draghi will likely be the market-moving event. At the last meeting it sent USD higher against all its major counterparts amid a heightened sense of risk aversion after the central bank cut inflation forecasts. Given the IMF’s recent global growth forecast, it is likely the ECB will deliver a similar outlook.

Today the 27 EU member states decide on whether to grant the UK government a Brexit extension. The emergency summit was called by European Council President Donald Tusk who has also proposed allowing a one-year flexible exit date, permitting the UK to leave on or before the one-year mark. Were this to occur, the UK would likely have to participate in the upcoming European parliamentary elections.

In the Nordics, Sweden’s Prospera inflation report is expected to be released with expectations that inflation will be lower than what Riksbank policymakers are hoping for. In Norway, CPI data will be published and is looking to outperform relative to economists’ expectations. This may largely be due to part the recent recovery in crude oil prices.

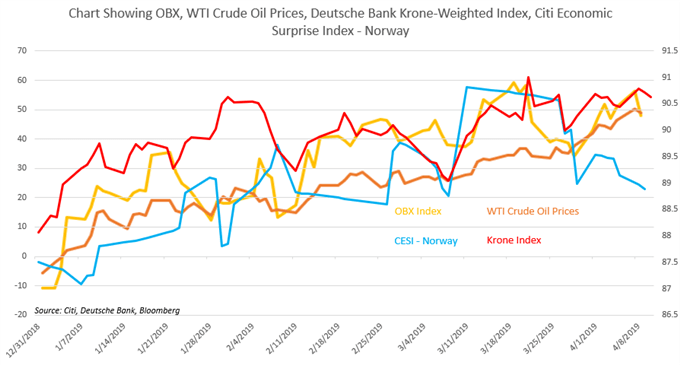

Because of the Norwegian economy’s heavy reliance on the petroleum sector, key benchmark assets – like the Krone and OBX equity index – closely track the movement in crude. This also leaves the country vulnerable to changes in global sentiment, a particularly important theme for Krone traders to keep in mind given the growing concern about waning global demand.

CHART OF THE DAY:

NORDIC TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter