GBP Price, News and Latest Analysis

- Unconfirmed market rumor that Germany would consider a five-year backstop limit.

- EU’s Barnier willing to look at a long Brexit extension – working towards an agreement.

Q2 2019 GBP Forecast and USD Top Trading Opportunities

British Pound Latest – Are the EU Floating Brexit Trial Balloons?

The EU Emergency Summit starts tomorrow with discussions over a Brexit extension top of the agenda. Ahead of these talks, a series of media rumors have hit the screen in what may be an attempt to find out the reaction of parties involved in a renewed attempt to break the EU/UK impasse. One such rumor – later denied – said that German Chancellor Angela Merkel was mooting a five-year time limit to the contentious Irish backstop, a situation that may well find approval with the waring factions within the UK Parliament and see the Withdrawal Agreement passed. PM May is scheduled to meet both German Chancellor Merkel and French President Macron today to try and find a way forward and to ask for an extension to the current Brexit timetable.

The news wires then became populated by commentary from EU chief negotiator Michel Barnier, via Reuters, saying that the orderly withdrawal of the UK from the EU ‘remains our objective’ adding that a No Deal would never be a decision taken by the EU who have been working towards an agreement. Barnier added that the UK can still revoke article 50 if they wanted but if they wanted to avoid a No Deal that the UK must vote for the Withdrawal Agreement.

While these comments are not new, the timing of them just before a major EU meeting on Brexit, and PM May’s meetings with Chancellor Merkel and President Macron, may be a small shift towards either getting a deal in place now or granting the UK a long extension to get a deal signed off, both of which would be Sterling-positive to different degrees.

Sterling (GBP) Fundamental Outlook: Leaning Towards a Softer Brexit?

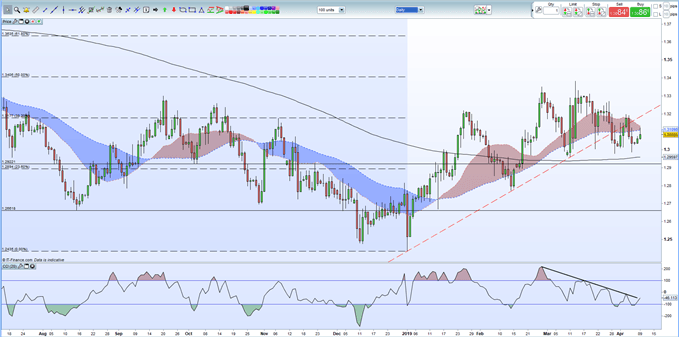

GBPUSD jumped around 50 ticks on the news flow to an intraday high of 1.3120 before edging back as traders continue to give Sterling the benefit of the doubt. We discussed recently that a positive Brexit premium priced into Sterling was being eroded and today’s ‘trial balloons’ may well curb that process, and it seems there is still little appetite to aggressively trade Sterling from the short-side.

Sterling Weekly Technical Outlook: GBPUSD & EURGBP Trends Creaking.

GBPUSD Daily Price Chart (July 2018 – April 8, 2019)

Retail traders are 72.0% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. See how recent daily and weekly positional changes affect GBPUSD sentiment – we are currently seeing a mixed trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.