AUDUSD IMPLIED VOLATILITY – TALKING POINTS

- AUDUSD overnight implied volatility skyrockets to 10.7 percent in anticipation of the Reserve Bank of Australia’s rate review expected Tuesday at 3:00 GMT

- Although markets are largely expecting the RBA to keep interest rates on hold at 1.50 percent, Governor Philip Lowe could provide supplemental information on the central bank’s latest view on monetary policy and economic outlook

- New to Forex? Check out this free Forex for Beginners educational trading guide

Forex option traders have bid up implied volatility on overnight AUDUSD contracts ahead of the Reserve Bank of Australia’s latest monetary policy decision slated for Tuesday at 3:00 GMT. While the central bank is widely expected to stay on the sidelines and leave its policy interest rate unchanged at 1.50 percent, follow-up commentary from Governor Lowe looks to provide AUD traders with additional insight on the RBA’s next move.

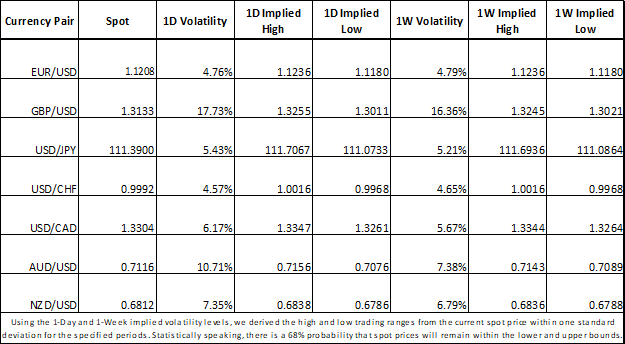

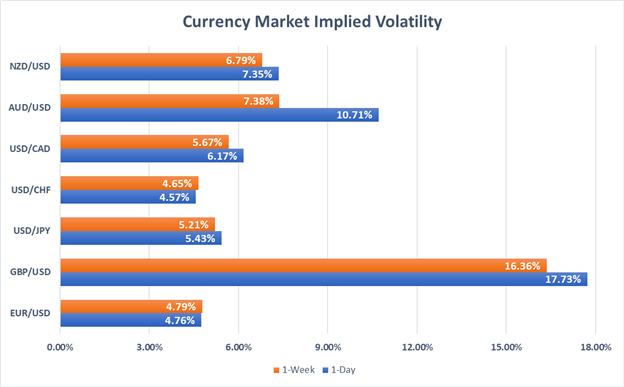

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

The accompanying monetary policy decision statement will likely highlight the latest developments in Australia’s labor and housing markets which largely contribute to the central bank’s relative dovish or hawkish tilt. Despite the Australian unemployment rate recently dropping to 4.9 percent, its lowest reading since June 2011, the RBA could still refrain from taking a less-dovish stance in consideration of neighboring New Zealand whose central bank hinted at cutting the country's policy interest rate last week.

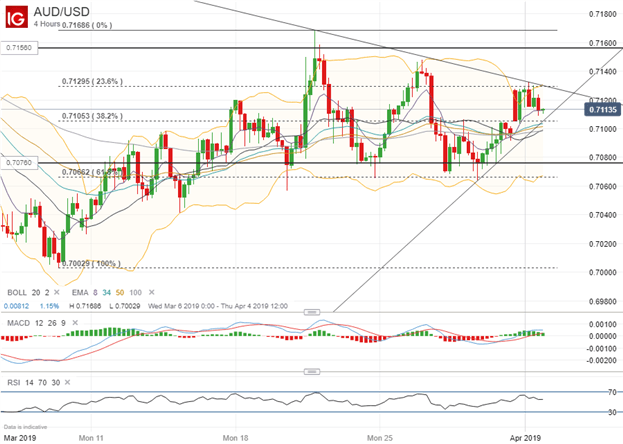

AUDUSD CURRENCY PRICE CHART: 4-HOUR TIME FRAME (MARCH 05, 2019 TO APRIL 01, 2019)

AUDUSD spot prices have recently traded between the 23.6 percent and 38.2 percent Fibonacci retracement lines drawn from March’s low and high. Although, the currency pair appears to have coiled between short-term trendlines which could position AUDUSD for a material break above downtrend resistance or below uptrend support. According to overnight implied volatility measures, however, currency market participants could expect AUDUSD to trade between 0.7076 and 0.7156.

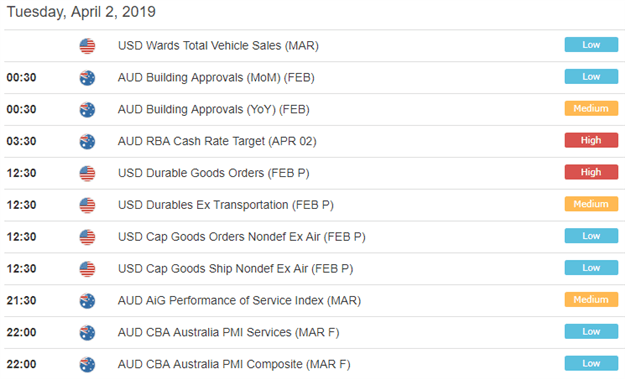

FOREX ECONOMIC CALENDAR – AUDUSD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

In addition to the RBA’s rate review, a handful of economic data out of Australia and the US could exacerbate AUDUSD price volatility. The latest reading on US Durable Goods Orders could move the market’s needle if actual data crosses the wires materially above or below consensus. Also, AiG’s Performance of Services Index has potential to send AUDUSD gyrating later in Tuesday’s session depending on the reading.

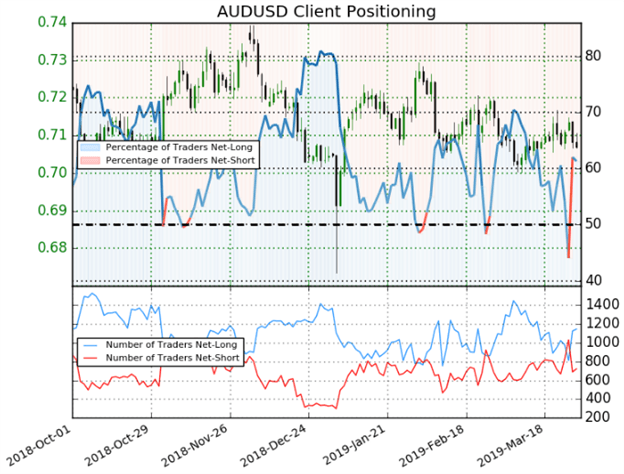

AUDUSD CLIENT SENTIMENT

Check out IG’s Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

According to IG’s client positioning data, 61.3 percent of AUDUSD traders are net-long with the ratio of traders long to short at 1.59 to 1. Moreover, traders have grown increasing bullish AUDUSD as the number of traders net-long is 11.4 percent higher than Friday and 26.9 percent higher compared to last week. However, we typically take a contrarian view to crowd sentiment which suggests AUDUSD prices may continue to fall.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter