EURUSD Price, Chart, Pivot Points and FOMC:

Q1 2019 EUR Forecast and USD Top Trading Opportunities

The Euro is currently in vogue as ‘the cleanest shirt in the laundry basket’ as the US dollar moves lower after a dovish FOMC meeting while Sterling still struggles with a lack of leadership from UK PM Theresa May.

Wednesday’s FOMC meeting saw the Fed downgrade economic growth and inflation forecasts and confirm that it will stop bond sales after September and taper its sales before this date. This ending earlier of the balance sheet reduction program gave the market another dovish jolt, pushing US Treasury yields lower. The 10 UST now yields 2.51%, the lowest level since January 2018, while the 30-year UST yields 2.96%, nearly 50 basis points than levels seen in October 2018. Lower bond yields feed through to a weaker currency.

US Dollar Dives After March FOMC Meeting Reveals Dovish Fed.

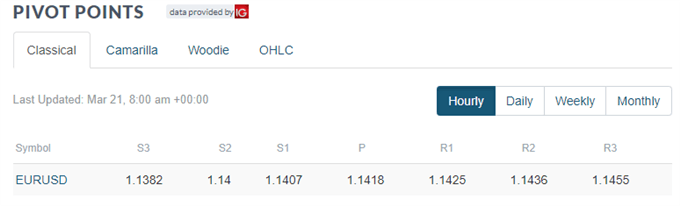

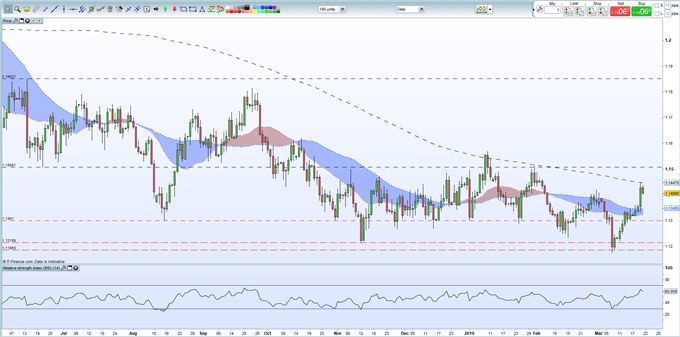

EURUSD Technical Analysis:

EURUSD touched a six-week high post-FOMC but backed-off the 200-day moving average around 1.1450. This dma will act as primary resistance in the short-term, while yesterday’s print may well have broken the sequence of lower highs seen since the start of the year. The early fade seen in the price today should find support from the 50-day moving average around 1.1350.

EURUSD Landing Page with Price Analysis, Charts, Pivot Points and Latest News and Views.

EURUSD Daily Price Chart (June 2018 – March 21, 2019)

EURUSD Retail Sentiment - Bias Remains Bullish

Retail traders are 37.7% net-long EURUSD according to the latest IG Client Sentiment Data, a bullish contrarian indicator. Recent changes in daily and weekly sentiment – net-short positions are 27.7% higher than last week - however give us a stronger contrarian bullish bias for EURGBP.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.