EURGBP Price, Volatility and Brexit

- EURGBP price analysis suggests further falls may lie ahead.

- Euro-Zone data this week may weaken the single-currency further.

Q1 2019 GBP Forecast and EUR Top Trading Opportunities

EURGBP–Technical Analysis

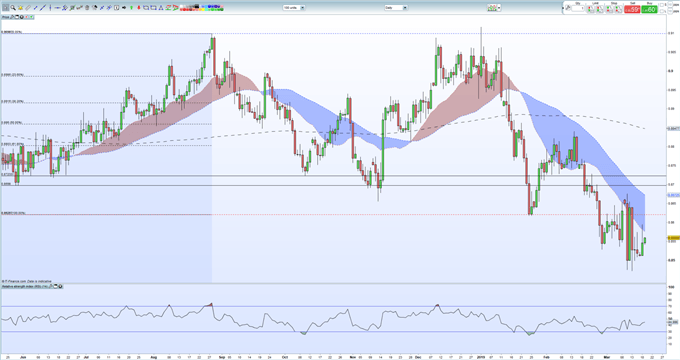

Ex-Brexit, the EURGBP chart remains negative and looks likely to move lower. A series of lower highs and lower lows define that chart from the start of 2019 and the pair currently trade below all three-moving averages, another negative set-up. To the upside there is resistance between 0.8615 and 0.8621, the January double low and the April 2018 swing-low respectively, before further levels of old horizontal resistance between 0.8655 and 0.8698. The RSI indicator is neutral to marginally oversold, so the next negative move may take some time to play out.

To the downside, initial support is the recent low at 0.84715 before the May 2017 swing-low around 0.8380. Just below here, the 161.8% Fibonacci extension at 0.8325 and the April 2017 swing-low at 0.8312.

Sterling Weekly Technical Outlook: Charts Highlight Bullish GBP Bias.

EURGBP Daily Price Chart (May 2018 – March 19, 2019)

Ahead this week, a batch of medium- to high-importance Euro-Zone economic releases with ZEW sentiment released this morning and the latest PMI numbers out early Friday morning. Further negative prints will increase fears that current economic weakness may be setting in, crimping growth and inflation expectation. The ECB has already said that it will soon launch TLTRO-3 to help boost bank lending, in the hope that this will help boost GDP and price pressure.

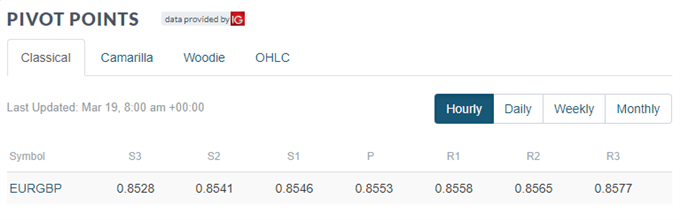

Retail traders are 57.9% net-long EURGBP according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest that EURGBP may soon reverse higher.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.