Asian Stocks Talking Points:

- Markets were higher almost across the board, with only the Kospi lagging and that not by much

- Hopes for some sort of US/China trade settlement remain high

- A dovish performance from the Fed would also reassure those worried about global growth

Find out what retail foreign exchange investors make of your favorite currency’s chances right now at the DailyFX Sentiment Page

Asian stocks were mostly higher on Monday as investors awaited trade developments between the US and China and looked forward to Wednesday’s US Federal Reserve monetary policy meeting.

The Fed isn’t expected to alter any of its settings but forecast tweaks, to suggest a slower economy, and fewer interest rate increases are expected, along with an end of current operation to unwind the vast balance sheet built up in the post-crisis phase.

On the trade front, a South China Morning Post report suggested that progress has been made between Washington and Beijing, with ‘concrete progress’ made on the text of a possible trade agreement.

While investors mulled all this, the Nikkei 225 added 0.6%, with Shanghai’s mainboard up 1.3% having erased earlier falls. The Hang Seng gained 0.8% and the ASX200 0.2%. Only Seoul’s Kospi was lower, and that by only 0.1%.

The US Dollar inched lower against major traded rivals as investors mulled the possibility of a more dovish Fed -although in truth that possibility has been with us for some time. The UK Pound stayed up on growing suspicions that Brexit will be delayed at least beyond the supposed hard date of March 29.

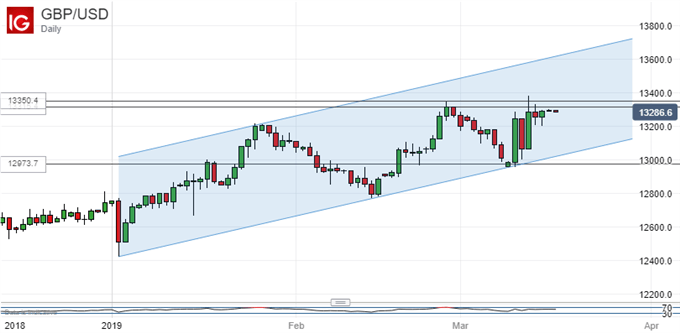

Still, GBP/USD seems stalled for now below resistance at late February’s peaks in the $1.3350 region.

The pair has managed to get above these on an intraday basis in the last week, but it will need to do so on a daily or weekly close this week to avoid the possibility of a ‘lower low’ formation.

Crude oil prices were lower as worries about global growth weighed on demand prognoses, although the prospect of more output cuts kept the market underpinned. Gold prices were modestly lower as risk appetite broadly held up.

Monday’s remaining economic schedule is extremely light the world over, with only the National Association of Home Builders March US housing market index likely to grab much market attention.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!