Oil Price Analysis and News

- Brent crude oil nears multi-month high.

- Record US-China trade deficit will rankle US President Trump.

DailyFX Crude Oil Landing Page – Prices, Charts, Analysis and Real-Time News

Crude oil prices continue to probe their recent multi-month high, aided by ongoing efforts by OPEC+ to restrict output, while power blackouts in Venezuela weigh on state-owned Petroleos de Venezuela production, according to media reports. While the supply-side outlook remains muted, ongoing fears that the US-China trade war looks unlikely to be resolved anytime soon will continue to crimp demand. In addition, recent data showed that the US-China trade deficit hit a record USD 419 billion, despite President Trump’s current trade tariffs and threats of further tolls on Chinese imports. Coupled with a slowing global growth backdrop, oil may struggle to push appreciably higher in the short-to-medium term. In late January, the IMF cut its global growth forecast for the second time in three months to their lowest levels in three years, highlighting increased downside risks to economic activity.

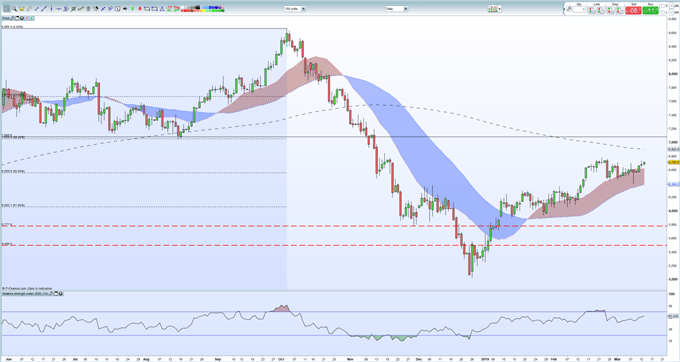

The crude oil chart shows the price within touching distance of the recent February 22 high and this may act as a target for traders to have one final push higher. After this $67.82/bbl. high, the 200-day moving average at $69.02/bbl. comes into play ahead of the 38.2% retracement of the June 2017-October 2018 rally at $70.56/bbl. To the downside, the 50% rally retracement at $65.59/bbl. remains first support ahead of the March 8 recent low at $64.00/bbl.

How to Trade Oil: Crude Oil Trading Strategies and Tips.

Brent Crude Oil Chart Daily Time Frame (June 2018 – March 13, 2019)

IG Client Sentiment shows that retail traders are 53.7% net-long of US Crude, a bearish contrarian indicator. However, recent daily and weekly positional changes warn that prices may soon move higher despite traders remaining net-long.

--- Written by Nick Cawley, Market Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1