GBPUSD Price, Volatility and Brexit

- GBPUSD eyes a cluster of support levels.

- PM May faces a heavy defeat on Tuesday in the HoC.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

Talks between the UK and the EU over the weekend failed to produce any solution to the Irish backstop situation, leaving PM Theresa May facing the possibility of another heavy defeat at Tuesday’s meaningful vote in the House of Commons. While this defeat would not be unexpected, there is now unsubstantiated talk that the meaningful vote may be pulled or changed to a provisional vote, although this remains very much up in the air.

With UK set to leave the EU in 18 days, the current deadlock between the two sides is expected to remain in place, with the March 21-22 EU Council meeting the last possible date for the two sides to agree a deal before the UK leaves the EU by default. And if market talk is to be believed, Theresa May could well be out of a job by the time of the EU Council meeting as forces circle within the Conservative Party to try and get a new leader sooner rather than later.

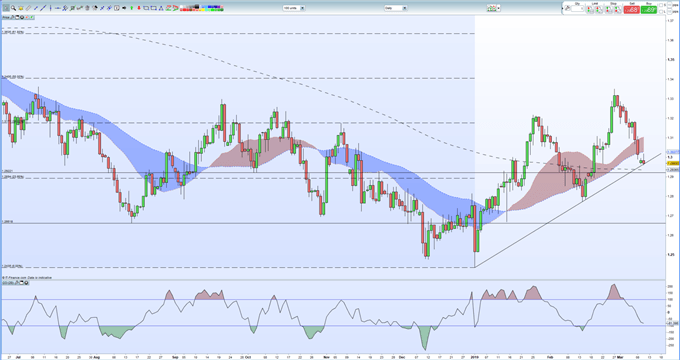

GBPUSD continues to trade either side of 1.3000 despite the heightened Brexit uncertainty. The US dollar as a currency remains relatively strong, yet cable continues to move noticeably lower. There is a cluster of support levels between 1.2965 (trend support), the 200-day moving average at 1.2937 and 23.6% Fibonacci retracement at 1.2894, with the latter needed to hold or the highs 1.27s will likely be tested. The RSI indicator is nearing oversold and is at its lowest level for a month.

GBP Fundamental Forecast: A Critical Week of Brexit Votes.

GBPUSD Daily Price Chart (June 2018 – March 11, 2019)

Retail traders are 65.4% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a stronger bearish trading bias for GBPUSD.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.