GBPUSD Price, Chart and Brexit:

- UK economy set to grow by just 0.1% in Q1 2019 according to sentiment data.

- Brexit talks continue in Brussels.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

The latest UK Services Markit PMI beat lowly expectations, registering 51.3 in February, up from a two-and-a-half year low of 50.1 in January. New work fell for the second consecutive month while employment numbers declined “at the fastest pace for over seven years as businesses opted to delay staff hiring in response to subdued demand and concerns about the near-term economic outlook”, according to data provider IHS Markit. They added that the data suggest that “the economy is on course to grow by just 0.1% in the first quarter”.

How Market Sentiment & Confidence Releases Can Improve Your Trading.

Brexit negotiations continue today with UK Attorney General Geoffrey Cox and Brexit Secretary Stephen Barclay back in Brussels looking to find a way to break the Irish border backstop impasse. There is growing talk that the EU and UK will agree on an arbitration mechanism to solve the backstop situation – the EU are still refusing to re-open the Withdrawal Agreement - although this may still struggle to get through the House of Commons.

Later in the session (15:35 GMT), Bank of England Governor Mark Carney will be giving evidence to the House of Lords Economic Affairs Committee. He is likely to be questioned about Brexit readiness and fears that globilisation could help spark a global recession.

Sterling Weekly Technical Outlook: GBP Slipping but Still Positive.

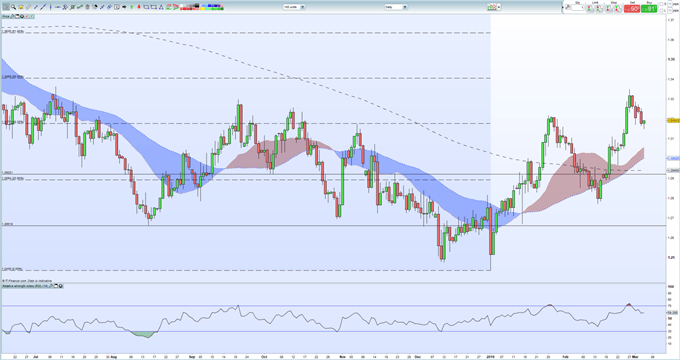

GBPUSD remains rangebound as talks continue. A stronger US dollar has weighed on the pair in the past few days and sideways trading is expected to continue all the way up to next votes between March 12-14. The chart suggest support between 1.3150 and 1.3177 in the short-term, although a break and close lower would bring the three-moving averages between 1.3060 and 1.2940 into play.

GBPUSD Daily Price Chart (June 2018 – March 5, 2019)

Retail traders are 52.4% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a mixed trading bias for GBPUSD.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.