Oil Price Analysis and News

- Trade War Hopes and Falling Rig Counts Support Oil

- Money Managers Boost Long Positions

Trade War Hopes and Falling Rig Counts Support Oil

Oil prices are on the front foot to begin the week, with Brent crude futures holding above $65/bbl. On Friday, the latest Baker Hughes rig count showed oil rigs drop by 10, consequently easing concerns over rapidly increasing shale production. Elsewhere, the boost in risk sentiment has also provided an undertone of support for oil prices after a WSJ report highlighted that the US and China are nearing a trade deal in which an agreement could be finalized at a summit between Trump and Xi on March 27th.

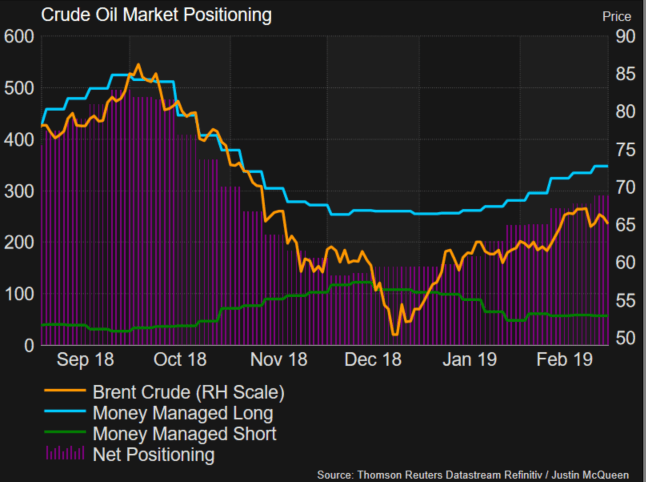

Money Managers Boost Long Positions

Positioning data has been relatively encouraging for oil bulls with money manager net-long positioning rising yet again. The rise had been attributed to the increase in long positions as opposed to short covering, subsequently, signaling renewed optimism within the oil complex.

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

More Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX