MARKET DEVELOPMENT – Gold Bulls Dominate, GBP Rises, SEK Sinks

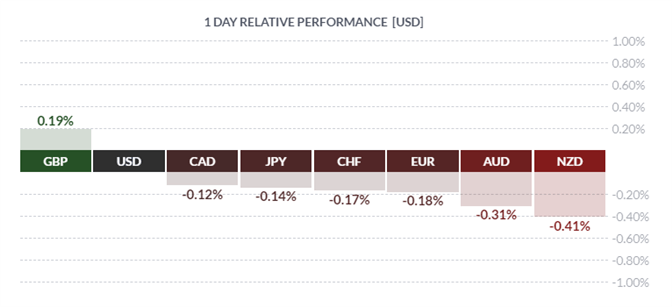

GBP: The Pound has grinded higher throughout the session with GBPUSD testing 1.2950. Much of the gains in the GBP can be attributed to the pullback observed in EURGBP, which is hovering around 3-week lows. On the data front, the UK employment report continued to show that the labour market remains robust (UK jobs review).

AUD / NZD: The Australian Dollar had once again been weighed down by the RBA. In which, meeting minutes provided a somewhat downbeat assessment of the external risks that Australia faces, while the housing market had also been flagged up as a key risk. Consequently, dropped towards the 0.71 handle while NZD also fell in sympathy.

SEK: The Swedish Krona is the notable underperformer in the G10 space after today’s inflation report fell short of analyst estimates and the Riksbank’s forecasts. As such, the SEK plunged over 1% against EUR and NOK given that this will likely reinforce the view that the central bank will be on hold for the rest of 2019.

Gold: The precious metal has continued to go on from strength to strength, despite the USD also edging higher. The global shift among central banks to a more accommodative stance has helped keep gold relatively firm, while fundamental demand via central bank buying has also provided a undertone of support. Eyes are for a test of resistance situated at $1350.

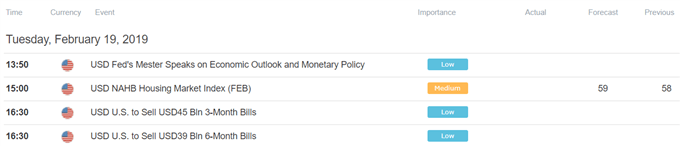

DailyFX Economic Calendar: – North American Releases

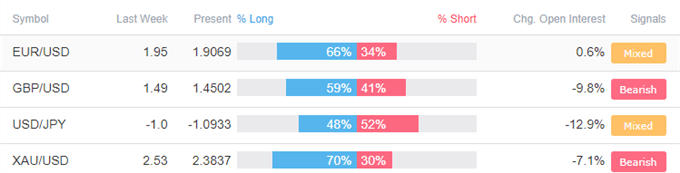

How to use IG Client Sentiment to Improve Your Trading

Four Things Traders are Reading

- “Key Charts to Watch: EURUSD Vulnerable to Auto Tariffs and Dovish ECB” by Justin McQueen, Market Analyst

- “Sterling (GBP) Underpinned by Robust UK Labour Market, Brexit Hopes” by Nick Cawley, Market Analyst

- “S&P 500, Dow, and Nasdaq 100 Charts: On to the Next Big Levels of Resistance” by Paul Robinson, Market Analyst

- “US-China Trade Talks and FOMC Minutes to Dominate USD Trading” by Martin Essex, MSTA, Analyst and Editor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX