- Global growth for 2019 trimmed by 0.2% to 3.5% from October’s projections.

- China’s growth slowdown could be ‘faster than expected if trade tensions continue’.

See all the DailyFX Q1 2019 Forecasts including the Euro, US dollar, Sterling and Oil.

Euro, US Dollar and IMF Growth Forecasts

The Euro took a small leg lower after the IMF released its latest growth forecasts, and it’s not a rosy outlook across the board. Advanced economies are set to grow by 2.3% in 2018, by 2.0% in 2019 and just 1.7% in 2020, according to the release. The United States is expected to see growth drop to 2.5% this year and 1.8% in 2020, China is expected to fall from 6.6% in 2018 to 6.2% in the next two years, while the Euro Area is projected to grow by 1.6% this year and 1.7% in 2020. Average oil prices are projected at just below $60/bbl. in 2019 and 2020, down from $66/bbl. and $69/bbl. respectively in the October forecast.

Crude Oil Price Eyes China Slowdown, IMF Growth Outlook Update

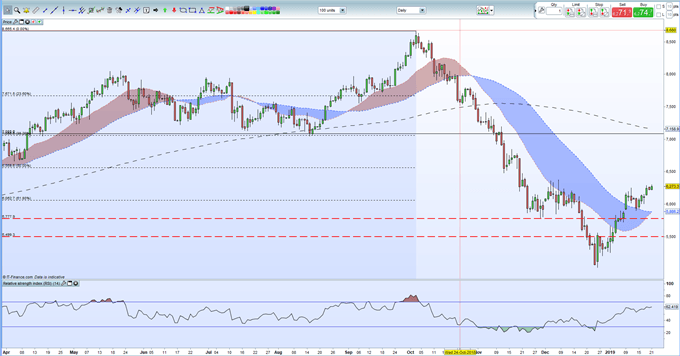

Brent Crude Oil Daily Price (April 2018 – January 21, 2019)

IMF Warns of ‘Further Deterioration in Risk Sentiment’

According to the IMF, ‘Risks to global growth tilt to the downside. An escalation of trade tensions beyond those already incorporated in the forecast remains a key source of risk to the outlook. Financial conditions have already tightened since the fall. A range of triggers beyond escalating trade tensions could spark a further deterioration in risk sentiment with adverse growth implications, especially given the high levels of public and private debt. These potential triggers include a “no-deal” withdrawal of the United Kingdom from the European Union and a greater-than-envisaged slowdown in China’.

GBPUSD Drops Ahead of Brexit Plan B

ECB Policy Meeting and Heavyweight German Data

Ahead this week we have important German ZEW and Ifo data, Tuesday and Friday respectively, along with the latest ECB monetary policy decision on Thursday where the central bank will leave all policy levers untouched. However, ECB President Mario Draghi may be in for a slightly uncomfortable press conference post-decision, with questions expected on how the central bank will try and boost inflation and growth now that the quantitative easing has ended.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on global growth – in line with the IMF? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.