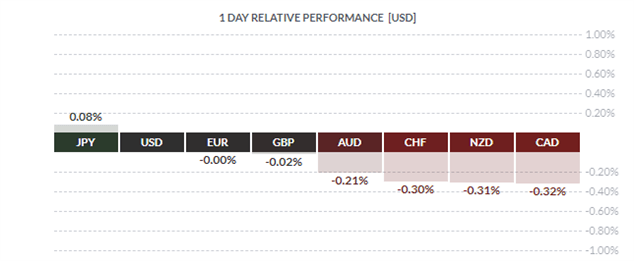

MARKET DEVELOPMENT – EURUSD Rejects Resistance, AUD Weighed by China Slowdown

USD: The US Dollar has oscillated between gains and losses this morning with little in the way of significant catalysts to provide any notable price action. This may indeed be the case for the rest of the session, given the US holiday.

GBP: Today’s focus will center around the UK and Theresa May presenting her Plan B Brexit plans to the House of Commons (1530GMT), while the debate and vote will take place on January 29th. As Brexit concerns remain, GBP has continued to pullback from the 1.30 handle. Eyes will also be placed on a series of potential amendments, with those pertaining to an extension of Article 50, could see GBP supported.

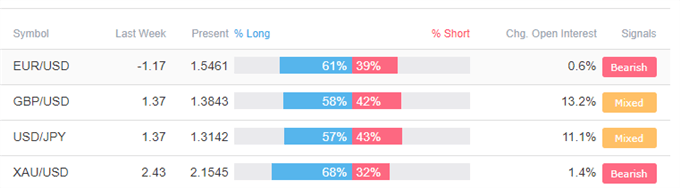

EUR: The Euro once again failed to consolidate above 1.14, however, support at the 23.6% Fibonacci retracement has curbed further declines for now. German PPI released this morning saw a sharper fall than expected in December (-0.4% vs. Exp. -0.1%). Investors are likely placing their attention on the upcoming ECB rate decision, although given Draghi’s recent dovish speech last week, it is unlikely to yield anything too significant. Consequently, option markets are pricing in a rather subdued 85pip breakeven in EURUSD throughout the week (covering the ECB event). Recent EURUSD range looks set to hold.

AUD: The Australian Dollar is on the backfoot to begin the week, albeit modestly. Chinese sentiment continues to dictate price action in the AUD. Overnight, Chinese GDP printed in-line with expectations with Q4 GDP slowing to the lowest level in a decade, while GDP for 2018 fell to 6.6% (28yr low). Consequently, the continued slowdown observed in China has weighed on the Aussie, while the uncertain environment surrounding China, could potentially force the RBA’s hand by dismissing the prospect that a rate hike is more likely than a rate cut. 0.7150 looks to be holding for now, with option activity, which is set to roll off tomorrow potentially magnetising price action.

How to use IG Client Sentiment to Improve Your Trading

Four Things Traders are Reading

- “Gold & Silver Price Analysis – Breakdowns Have Key Support in Focus” by Paul Robinson, Market Analyst

- “Crude Oil Price Eyes China Slowdown, IMF Growth Outlook Update”by Nick Cawley, Market Analyst

- “GBPUSD Drops Ahead of Brexit Plan B” by Justin McQueen, Market Analyst

- “FTSE 100 Eyes Brexit Plan B, Record Chinese Stimulus Raises Alarm Bells” by Justin McQueen, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com Follow Justin on Twitter @JMcQueenFX