GBP Price Analysis and Talking Points:

- GBP Awaits Plan B

- Eyes on Amendments

See our quarterly GBP forecast to learn what will drive prices throughout Q1.

GBP Awaits Plan B

Today’s focus will center around the UK and Theresa May presenting her Plan B Brexit plans to the House of Commons, while the debate and vote will take place on January 29th. According to UK press reports over the weekend, the PM’s efforts to hold cross party discussions appears to be on hold for now, with Theresa May looking to get support from hardline Brexiteers in the Conservative Party and the DUP through renegotiating the Irish backstop. However, with little progress made, GBP is slipping ahead of the PM’s address (1530GMT) with the markets viewing this as an unlikely way to get a Withdrawal Agreement passed.

Eyes on Amendments

With there being little progress made on Theresa May’s Plan B relative to Plan A GBP is on the backfoot. As such, eyes will be on a series of amendments. Those pertaining to an extension to Article 50 could see GBP supported as no-deal Brexit risks recede. However, given the uncertainty over Brexit and the lack of clarity, GBP rallies have been consistently faded.

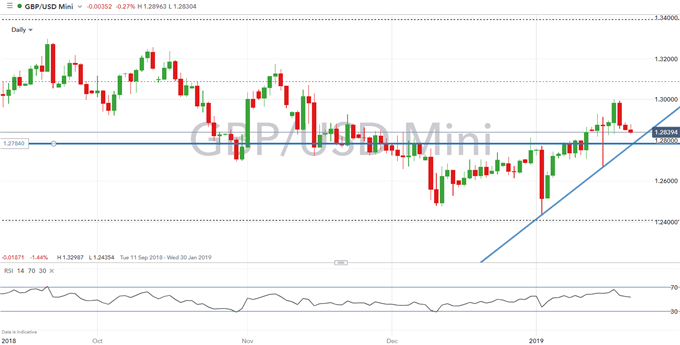

GBPUSD PRICE CHART: Daily Time-Frame (Sep 2018 – Jan 2019)

After a notable pullback from the 1.30 handle, GBPUSD has now broken below the 100DMA situated at 1.28889. Subsequently, opening the pair up for further losses with eyes on the 61.8% Fibonacci retracement of the 1.1800-1.4377 rise (1.2784).

GBP TRADING RESOURCES:

- See our quarterly GBP forecast to learn what will drive prices throughout Q1.

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX